Asset-Based Lending

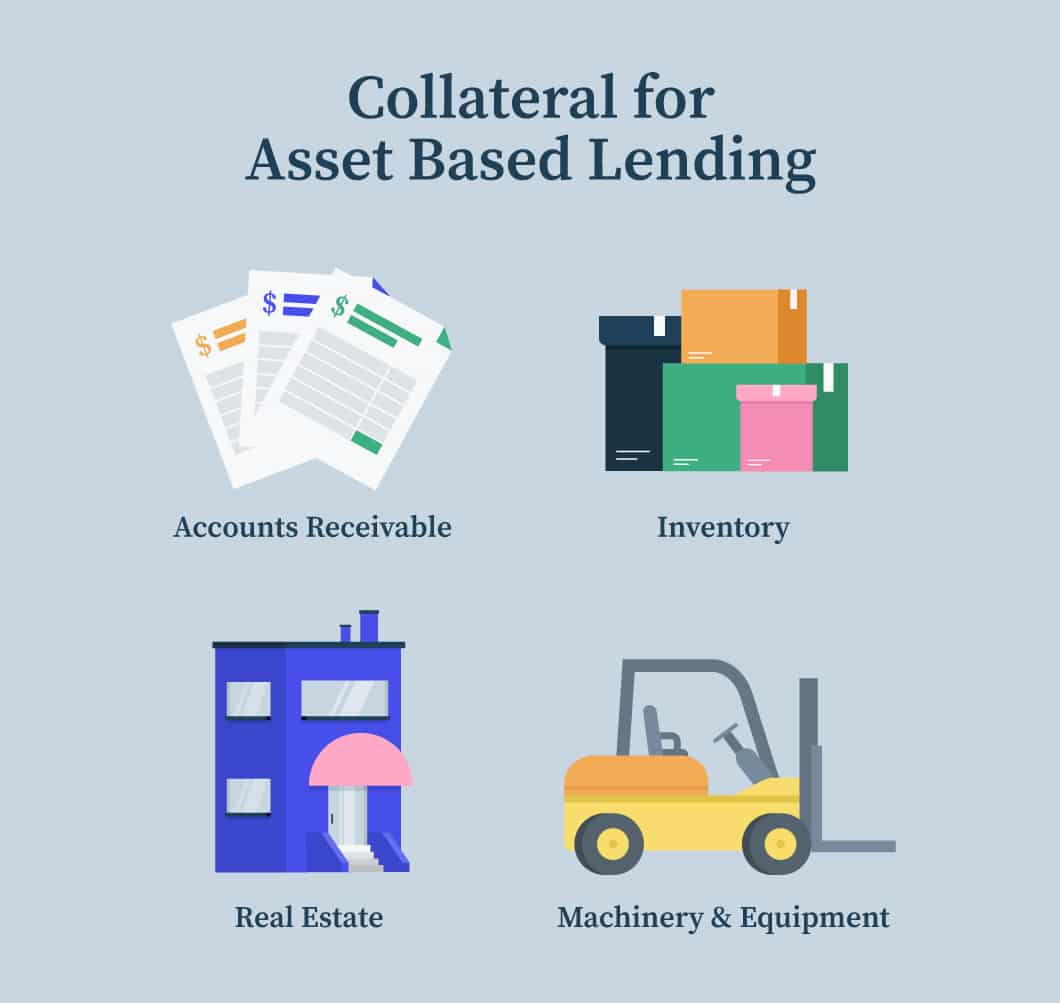

Asset-based lending, also known as asset financing or collateralized loan, is a type of financing in which lenders offer loans based on the value of the borrower’s assets. The most common form of asset-based lending involves secured borrowing against existing accounts receivable and inventory, although other types of assets can be used such as real estate or equipment.

Unlike traditional forms of financing that are heavily reliant on creditworthiness and debt capacity, asset-based lending does not require these factors to obtain approval for a loan. Instead, this type of loan offers preferential terms for businesses with high levels of liquidity and low risk associated with their assets. Asset-based lenders are typically commercial banks but can also include specialized finance companies who specialize in providing capital to businesses whose cash flow may not support conventional sources of funding.

The primary benefit that asset-based lending provides is flexibility; since it relies more on collateral than credit scores or repayment history, borrowers have access to larger sums at competitive rates regardless if they have poor credit history or limited financial data available to evaluate their worthiness for a loan. Asset-backed security transactions also tend to close faster than traditional loans due to the lender’s ability to secure collateral upfront rather than relying solely on an applicant’s promise to repay over time. This makes them an attractive option for businesses looking for quick access to working capital without having the hassle associated with lengthy applications and review processes involved in obtaining traditional business loans from banks or other institutions.

In addition, asset-backed securities often come with fewer restrictions compared with traditional bank loans (such as personal guarantees) which allows borrowers greater freedom when using capital obtained through this method. Finally, because secured borrowing utilizes existing assets within the company itself instead external sources (e.g., from investors), owners retain full control over how funds are utilized while reducing any potential downside risks associated with giving away equity stakes in return for cash infusions into their business models

To summarize: Asset Based Lending is a type of flexible financing where funds are borrowed against existing assets like accounts receivables and inventory instead relying solely on an applicant’s promise alone – making it easier/faster way acquire working capital without needing good credit score/history/financial statements etc It also comes few restrictions compared regular bank loans so entrepreneurs gain more control over how they use funds while mitigating risk associated giving up equity stakes in return cash investments