Have you ever wished that you could access financial services without going through the traditional banking system? Decentralized Finance (DeFi) is a new technology that has the potential to unlock limitless financial possibilities. DeFi offers many advantages, such as increased transparency and security, access to services beyond traditional banking networks, and the potential for more efficient, higher yields. But it also comes with risks such as lack of regulation, volatility, and lack of user protection. So what exactly is DeFi, how does it work and could it be a game changer for the future of finance? This article seeks to provide answers to these questions and explore DeFi’s current market and its potential for growth.

Table Of Contents

Introduction

Decentralized finance (DeFi) is revolutionizing the way people access financial services. By enabling users to connect with a variety of different financial products outside of traditional banking networks, this new technology has unlocked countless new possibilities for those who seek to make smarter investments with greater transparency and security. Moreover, the potential for higher yields and more efficient returns has made DeFi an attractive option for many investors. However, with this newfound freedom and opportunity comes its own unique set of risks and challenges that must be carefully considered before taking part.

This article seeks to explain what DeFi is, how it works, while also exploring the advantages and disadvantages of this innovative technology. We will provide an overview of DeFi’s current market, as well as its potential for growth in the future. DeFi is a relatively new phenomenon and as such, there is still much to be learned about its implications. That being said, by understanding the fundamentals of DeFi, investors can better equip themselves to make informed decisions about their investments.

The advantages and benefits of DeFi are numerous and significant – from increased security and transparency to more efficient yields, this technology has the potential to open up a world of financial opportunities. However, it’s important to note that while the potential rewards are great, so too are the potential risks associated with DeFi. Lack of regulation, associated volatility, and lack of user protection can all put investors at risk if they do not properly understand how DeFi works and the potential risks involved.

By understanding both the advantages and disadvantages of DeFi, investors can make better decisions about how they want to participate in this new technology. Finally, we will provide an overview of DeFi’s current market as well as its potential for growth in the future so that investors can keep abreast of changes in this rapidly evolving global landscape.

What is Decentralized Finance (DeFi)?

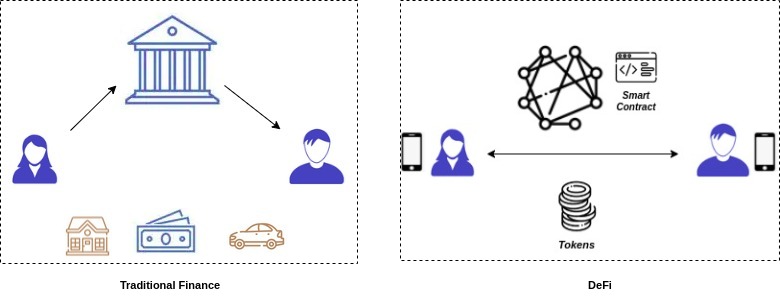

Decentralized Finance (DeFi) is a new financial paradigm that operates outside of traditional banking networks and infrastructure. It is a set of smart contracts and protocols built on blockchain technology that enables users to access a variety of financial services, such as lending, borrowing, trading, investing, saving, insurance and more. Unlike traditional systems, DeFi eliminates the need for intermediaries as it allows direct peer-to-peer (P2P) transactions to take place securely and instantly. This means that instead of relying on centralized institutions like banks or governments to dictate the terms of their agreements and access to financial services, users are able to take control over their own finances without a middleman.

Adopting DeFi also grants users access to new markets and sources of liquidity that are not available in traditional banking systems. With decentralized exchanges (DEXs), for example, users can trade tokens directly with one another without having to go through a gateway or third party broker. This provides them with more options when it comes to buying and selling tokens and can help them find better rates than those offered by traditional exchanges. Additionally, DeFi platforms often offer higher yields than those provided by conventional banks due to their trustlessness, transparency and efficiency—making them attractive investments for those looking to maximize their returns.

While there are many advantages associated with adopting DeFi, there are also some risks involved. For example, since most DeFi projects have yet to be regulated by any government body or central authority, this means they can be subject to increased risk as there is no one overseeing them at the moment. Additionally, due to the nature of cryptocurrencies being volatile assets, investments made through DeFi platforms may be subject to significant losses if market conditions do not remain favorable. As such, investors must exercise caution when engaging in these kinds of activities and understand the risks involved. Furthermore, there is a need for improved user protection in order to help safeguard against potential malicious actors.

In summary, Decentralized Finance presents users with the opportunity to access financial services without relying on traditional banking networks or infrastructure. It offers advantages such as increased autonomy over their own funds and access to new markets with higher yields than conventional banking systems; however risks such as lack of regulation and volatility must also be taken into consideration. In order for DeFi to truly unlock its full potential it will need further development from both users and developers alike in order to ensure proper protection from malicious actors and further

Advantages of DeFi

One of the greatest advantages of Decentralized Finance (DeFi) is that it provides access to financial services outside of traditional banking networks. By leveraging decentralized technology, users around the world can connect directly with one another, creating an efficient and cost-effective financial ecosystem. Furthermore, the open-source nature of blockchain technology allows anyone with an internet connection and adequate technical knowledge to develop their own financial solutions and services, encouraging innovation and growth. This means that DeFi solutions can be deployed quickly and efficiently, while also being responsive to user demands.

In addition, DeFi transactions are more transparent, secure and immutable than those conducted through traditional financial systems. Since all transactions are recorded on a secured public ledger, known as a blockchain, the information is visible for anyone to view. This eliminates the risk of fraud or tampering as each transaction must be verified by consensus before it can be executed. Furthermore, due to the decentralized structure, any malicious attempts to censor or modify information will be rejected by other users in the network. Thus, DeFi solutions provide an extra layer of security that is not available in traditional banking networks.

Efficiency is another attractive advantage offered by DeFi compared to traditional banks. With decentralized protocols such as Automated Market Makers (AMM), users can easily borrow and lend assets with greater flexibility in terms of duration and interest rates. Additionally, financial instruments such as Decentralized Exchange (DEX)s allow individuals to trade assets without entrusting custody to a third party – thus reducing fees and improving efficiency compared to traditional exchanges. This is especially beneficial for users who want quick access to capital or want to generate regular income with their assets. It also ensures that funds are always accessible and market opportunities can be acted upon immediately – something which is not always possible with traditional banking methods.

Overall, the advantages of Decentralized Finance (DeFi) have the potential to revolutionize financial services by unlocking limitless possibilities for users around the world. From increased transparency and security to improved efficiency and higher yields – DeFi offers a wide range of benefits that can make it an attractive alternative for individuals looking for an alternative way to manage their finances.

Risks Associated with DeFi

Despite its numerous advantages over traditional finance products, there are still some risks associated with investing in DeFi products that investors should be aware of. One of the biggest risks is the lack of regulation for these products. Since DeFi networks are governed by distributed protocols rather than centralized authorities, there is no one responsible for overseeing the system and enforcing regulations or consumer protections. This means that users have to rely on their own due diligence when deciding whether to invest in a product or not, which can be risky if they are not experienced or knowledgeable about the industry.

Moreover, there is also the possibility of volatility, which makes it difficult to accurately predict returns. Since DeFi products are not regulated and prices can fluctuate rapidly, there is a greater chance that users might lose money if they do not understand how to manage their investments properly. Furthermore, since these networks are decentralized, there is a heightened chance of malicious activity and user protection needs to be improved. As such, users should take extra caution when investing in DeFi products and ensure that they understand all associated risks before putting any money into these products.

Overall, while DeFi has great potential to disrupt traditional forms of finance, it is important to understand the associated risks before investing in these products. By understanding the potential rewards and risks associated with DeFi investments, investors can make more informed decisions about how to best use this technology to maximize their returns.

Overview of DeFi’s Current Market

DeFi has become increasingly popular in recent years, with a wide variety of decentralized finance protocols and applications being developed. Currently, there are over $46 billion locked up in DeFi protocols and products, making it one of the fastest-growing sectors in the crypto space. The top five DeFi protocols, according to market capitalization, are Aave, MakerDAO, Uniswap, Compound, and Synthetix – all of which offer a range of different products and services.

Aave is a decentralized lending platform that allows users to borrow and lend cryptocurrency tokens at preferential rates. MakerDAO’s Dai is a stablecoin secured by the underlying Ethereum blockchain. Uniswap is a platform for automated token exchange. Compound is a decentralized protocol that allows people to lend or borrow cryptocurrency tokens for interest. Finally, Synthetix is an on-chain derivatives platform that allows users to trade synthetic assets such as stocks or foreign currencies.

In addition to these platforms, there are also numerous third-party providers offering DeFi services such as secure borrowing and lending services, stablecoin issuance and management, insurance coverage, and automated investment strategies – among many other features. As more users come to understand the unique advantages that DeFi offers over traditional finance – such as its low fees, operational transparency, and secure infrastructure – its growth is set to continue at an accelerated rate for many years to come.

DeFi’s Potential for Growth

The decentralized finance (DeFi) space has grown exponentially in recent years and its potential for continued development only continues to grow. The number of DeFi protocols and applications have increased drastically, creating new opportunities for users to access financial services outside of traditional banking networks. Furthermore, tokens and assets issued through DeFi protocols are becoming more accessible to users of all sizes, while experienced investors are increasingly entering the market creating more liquidity and growth potential.

Open ecosystems such as Ethereum, Binance Smart Chain, and Polkadot have made it easier for developers to build new DeFi applications and protocols, further contributing to the sector’s growth. Moreover, DeFi projects have a strong presence in numerous industries such as payments, insurance, banking, lending and more – this creates more opportunities for collaboration between businesses. This could potentially lead to even greater growth in the DeFi space in the future.

The increasing accessibility of DeFi services will also add to its potential for development. With improvements in usability, user protection measures that are being put into place, and greater transparency within the sector, it is likely that there will be an influx of individuals who are interested in exploring what DeFi has to offer. This could potentially lead to a larger userbase that is more diverse than ever before.

Overall, the potential for growth within the decentralized finance (DeFi) sector is clear. The number of protocols and applications has increased substantially over the past few years and its presence in various industries such as payments, insurance, banking and more provides many opportunities for collaboration which could drive continued development. Furthermore, with improved usability, user protection measures being implemented, and increased transparency there is likely to be an influx of individuals who are curious about what DeFi has to offer which could further contribute to its growth potential in the years ahead.

Conclusion

In conclusion, DeFi has the potential to revolutionize the way people access and use financial services. A decentralized framework means traditional banking networks are no longer needed, unlocking limitless financial possibilities for individuals and institutions alike. Furthermore, DeFi offers many advantages including increased transparency, security, and higher yields. Despite the associated risks of volatility and lack of regulation, these can be mitigated with improved user protection measures.

DeFi’s current market is growing rapidly as more platforms enter the space and increase competition, which in turn encourages innovation through new products and services. Given the potential for growth, DeFi may become an increasingly attractive option, particularly in countries where traditional banking systems are inaccessible or inefficient. By providing an alternative to centralized financial services, DeFi has the potential to create a more equitable financial system around the world.

Decentralized Finance (DeFi) has the potential to unlock limitless financial possibilities. The advantages of DeFi are numerous, such as the ability to access financial services outside of traditional banking networks, increased transparency and security, and the potential for more efficient and higher yields. However, DeFi also has its risks, such as the lack of regulation, the associated volatility, and the need for improved user protection. Despite this, the market for DeFi is growing rapidly and there is potential for further growth. With the right combination of innovation and caution, DeFi could offer great opportunities to unlock financial potential.

Frequently Asked Questions About Decentralized Finance (DeFi)

What are examples of decentralized finance?

1. Decentralized Exchanges (DEX): These are peer-to-peer exchanges that enable users to trade digital assets without relying on a centralized entity.

2. Decentralized Lending Platforms: These allow users to borrow or lend assets without relying on a centralized entity.

3. Decentralized Insurance Platforms: These are platforms that enable users to hedge against the risk of cryptocurrency price volatility without relying on a centralized entity.

4. Decentralized Prediction Markets: These are platforms that enable users to trade on the outcome of events without relying on a centralized entity.

5. Decentralized Stablecoins: These are digital assets designed to remain as stable as fiat currencies by relying on a variety of mechanisms to maintain their peg.

6. Decentralized Derivatives: These are digital assets that are derived from underlying assets such as stocks, commodities or cryptocurrencies.

Can you make money with decentralized finance?

Yes, it is possible to make money with decentralized finance (DeFi). DeFi allows users to access a range of financial services, including lending, borrowing, trading, and investing. By using DeFi, users can earn yield from lending and borrowing platforms, collect fees from trading and investing, and access a range of other services.

Is decentralized finance safe?

Decentralized finance (DeFi) is still a relatively new concept, so it’s important to do your own research before investing in any DeFi project. While it has the potential to offer benefits such as faster transactions and greater security, it can also involve higher risk due to its lack of regulation, which can make it vulnerable to scams and other malicious activities. Be sure to read up on the project, the team behind it, and any other factors that could affect your investment before getting involved.

Is Bitcoin a DeFi?

No, Bitcoin is not a DeFi (decentralized finance) asset. Bitcoin is a digital asset and payment system that is powered by a distributed public ledger called a blockchain. DeFi assets are digital assets built on top of Ethereum that are specifically designed to enable financial services such as lending, borrowing, and trading.

What Does Decentralized Finance Do?

Decentralized finance (DeFi) is a type of financial system that operates on the blockchain and is not reliant on a single centralized authority. DeFi applications provide users with access to financial services, such as loans, borrowing, trading, and insurance, without having to go through a traditional financial institution. By removing the need for third-party intermediaries, DeFi applications can offer users access to a greater range of services, lower fees, and faster transactions. Additionally, DeFi applications are built on top of open-source protocols, meaning that the code is public and anyone can audit the code to ensure its integrity.