Do you ever feel like the crypto markets are too volatile and unpredictable? Have you been searching for an effective way to revolutionize your crypto portfolio? If so, then algorithmic stablecoins could be your answer. Algorithmic stablecoins provide a range of advantages over traditional crypto, including increased liquidity, reduced fees, and decreased slippage. With the right approach and proper utilization, algorithmic stablecoins can be used as a powerful tool to diversify a portfolio, manage risk, and maximize returns. Unlock the potential of algorithmic stablecoins today and discover the possibilities they offer.

Table Of Contents

Introduction

Cryptocurrency markets are becoming increasingly complex and unpredictable. Evaluating potential investment opportunities is becoming more difficult as the crypto asset class matures, and traders must be prepared to navigate its volatility if they hope to be successful. Algorithmic stablecoins offer a new approach to managing risk and increasing returns in these volatile markets. This article explains the basics of algorithmic stablecoins, their advantages, and how they can be used strategically to maximize profits.

Algorithmic stablecoins are digital assets that are backed by algorithms rather than real-world collateral. Instead of being pegged to a fiat currency or other asset, algorithmic stablecoins use complex mathematical formulas to regulate their supply and demand in response to market conditions. This helps ensure that their value remains relatively stable over time in spite of wider market fluctuations. The result is a reliable digital asset that provides increased liquidity, reduced slippage, and lower fees compared to conventional cryptocurrencies, making them an attractive option for investors looking to diversify their portfolios or hedge against volatility.

In addition to providing greater stability in turbulent times, algorithmic stablecoins also allow traders to access sophisticated tools such as smart contracts and automated trading strategies. With these tools at their disposal, traders can create tailored portfolios to suit their individual objectives and gain exposure to numerous different markets without having to worry about the volatility associated with conventional cryptos. Furthermore, algorithmic stablecoins offer an unparalleled level of transparency compared to other assets which makes it easier for investors to monitor their investments and make informed decisions.

The potential benefits of algorithmic stablecoins are clear, but how do you unlock them? In the next sections, we will explore how you can use algorithmic stablecoins to diversify your portfolio, manage risk, and increase returns. We will also discuss the practical steps you need to take in order to unlock the potential of algorithmic stablecoins and take advantage of the opportunities they offer.

Advantages of Algorithmic Stablecoins

Algorithmic stablecoins are a revolutionary addition to the cryptocurrency landscape, offering a range of advantages for crypto portfolios. Firstly, algorithmic stablecoins offer increased liquidity compared to other conventional crypto assets. This means users have access to greater volumes of coins available on the market, enabling them to buy and sell at a faster rate. Furthermore, algorithmic stablecoins are specifically designed to reduce slippage and minimize market fluctuations during trading. This can enable traders to benefit from more consistent price movements in the market, meaning that they can enter and exit positions with confidence.

In addition to this, algorithmic stablecoins provide users with access to lower fees and transaction costs than traditional crypto assets. These lower costs can be especially beneficial for traders who plan on conducting frequent trading activities or those looking to take advantage of small price movements in the market. As algorithmic stablecoins are designed to provide a more robust, secure, and transparent system than other conventional digital assets, users can also rest assured that their funds are safe and that the system is reliable and trustworthy overall.

In conclusion, algorithmic stablecoins offer a range of advantages that can help revolutionize a crypto portfolio. With increased liquidity, reduced slippage, lower fees, and improved security measures compared to other conventional digital assets, algorithmic stablecoins can provide users with an opportunity to unlock potential profits in the long run.

Diversifying Portfolios with Stablecoins

Stablecoins offer an excellent way to diversify and balance your cryptocurrency portfolio. With stablecoins, investors can easily spread their risk across different asset classes without incurring high costs or liquidity risks associated with traditional asset classes such as stocks, bonds, or commodities. In addition, algorithmic stablecoins provide the potential to reduce volatility and mitigate downside risks in a portfolio by maintaining a constant value regardless of market fluctuations. This can be particularly beneficial for investors who are looking for long-term growth while avoiding short-term losses due to price drops in the crypto markets.

By investing in multiple asset classes, investors can better manage their risk and maximize their returns in the long-term. For example, a well-balanced portfolio should contain both riskier investments (such as cryptocurrencies) and more stable investments (such as algorithmic stablecoins). This allows investors to benefit from the higher returns available in riskier investments while mitigating losses through more stable investments. In addition, by diversifying across different asset classes, investors can also take advantage of opportunities for arbitrage trading, which involves buying and selling coins at different prices across various exchanges.

Algorithmic stablecoins can also be used as a hedge against market volatility and losses due to price drops in other cryptocurrencies. This can help investors manage their risk by providing an alternative investment option that is not affected by price fluctuations, allowing them to protect their profits while continuing to participate in the crypto markets. Furthermore, because these coins are backed by algorithms instead of physical assets, they offer more flexibility than other types of investments and can be used as an effective tool for managing risk in a portfolio.

Finally, algorithmic stablecoins can also be used to increase returns in a cryptocurrency portfolio by taking advantage of low fees and high liquidity. By investing in coins with low fees and high liquidity, investors can capitalize on opportunities for arbitrage trading which allows them to take advantage of price discrepancies across exchanges without having to own large amounts of any one coin. This can lead to lucrative returns over time when done correctly.

Overall, algorithmic stablecoins offer many ways for investors to diversify their portfolios and manage risk while increasing their returns. By taking advantage of the benefits offered by these coins, investors can revolutionize their crypto portfolios and unlock the potential of algorithmic stablecoins now.

Managing Risk with Stablecoins

Algorithmic stablecoins provide an effective risk management strategy for crypto portfolios. By investing in algorithmic stablecoins, investors can reduce the volatility of their investments and minimize their exposure to market risks. Furthermore, algorithmic stablecoins provide a safe haven asset in times of market stress, helping investors protect their capital from potentially damaging losses.

One benefit of investing in algorithmic stablecoins is that they can reduce the overall volatility of a portfolio. This is because these coins are designed to maintain a fixed value relative to another asset, such as the US dollar or gold. As such, they remain relatively stable in value even when the prices of other cryptocurrencies fluctuate widely. By investing more heavily in algorithmic stablecoins during periods of market stress, investors can effectively reduce their exposure to market risks and protect their capital from potential losses.

Another advantage of algorithmic stablecoins is that they provide a safe haven asset in times of market stress. Unlike traditional safe haven assets such as gold and US Treasuries, algorithmic stablecoins are easy to acquire and trade on cryptocurrency exchanges. As such, investors can take advantage of the protection that these coins offer without having to invest in potentially expensive and difficult-to-obtain assets. By investing in algorithmic stablecoins during periods of market volatility, investors can protect their investments while still taking advantage of potential gains from other assets in their portfolios.

Finally, algorithmic stablecoins offer an effective risk management strategy for crypto portfolios by allowing investors to minimize their exposure to market risks while still being able to take advantage of potentially lucrative returns. By diversifying their portfolios with algorithmic stablecoins, investors can reduce the overall volatility and risk associated with their investments while still taking advantage of opportunities for growth. Additionally, by investing in algorithmic stablecoins during times of market stress, investors can reduce their exposure to losses and increase their returns over time.

Overall, algorithmic stablecoins offer an effective way for investors to manage risk in a crypto portfolio. By investing in these coins, investors can reduce the volatility of their investments and minimize their exposure to market risks. Furthermore, these coins provide a safe haven asset for investors during times of market stress. Finally, investing in algorithmic stablecoins allows investors to maximize their returns while minimizing their exposure to risk. With the potential benefits that these coins offer, it is no wonder why many investors are now turning to them as an effective way to manage their crypto portfolios.

Increasing Returns with Stablecoins

Algorithmic stablecoins can be an effective tool for increasing returns on a cryptocurrency portfolio. For one thing, algorithmic stablecoins can take advantage of arbitrage opportunities in the market by allowing traders to buy low in one exchange and sell high in another quickly and efficiently. This opportunity is particularly attractive for traders due to the low fees associated with algorithmic stablecoins, as well as their increased liquidity. Furthermore, algorithmic stablecoins offer greater price stability than traditional cryptocurrencies; this means that investors don’t need to worry about drastic changes in prices due to market volatility.

Additionally, looking beyond arbitrage opportunities, investors can benefit from the yield opportunities offered by earning interest through DeFi protocols such as Compound and Aave by using algorithmic stablecoins as collateral for loans or deposits. These protocols use smart contracts to facilitate peer-to-peer lending and borrowing transactions, allowing users to capitalize on yields that are currently not available through traditional financial institutions. Furthermore, these protocols also provide additional security for investors who want to ensure that their funds are protected from potential losses due to market volatility.

Finally, algorithmic stablecoins can also be used as a hedge against market volatility; since they are pegged to fiat currencies such as USD or EURO, they provide a reliable store of value that does not fluctuate with the market. This provides investors with an additional layer of security and helps them manage risk more effectively. In summary, algorithmic stablecoins offer numerous opportunities for maximizing returns on a cryptocurrency portfolio and should not be overlooked by investors looking to maximize their potential profits.

Practical Steps to Unlock the Potential of Algorithmic Stablecoins

Choosing the right algorithmic stablecoin provider is essential to ensure reliable services. Researching the company’s reputation and considering the set of features it offers is important. Additionally, investors should look for algorithmic stablecoins that have good liquidity, are backed by reputable institutions, and are regulated by various government agencies.

Carefully assessing the performance and stability of algorithmic stablecoins before investing is essential. It is important to take into account not just the historical performance of the asset, but also its proposed future growth prospects. Ensuring that the algorithmic stablecoin follows a predictable protocol and abides by certain monetary policies can be helpful in this regard.

Consider diversifying your portfolio with algorithmic stablecoins to reduce risk and increase returns. Due to their lower volatility, algorithmic stablecoins are a great way to minimize loss during market downturns and spread risk more evenly. Additionally, as algorithmic stablecoins can maintain consistent returns over time, they can provide investors with higher yields than traditional fiat currencies or assets.

Take advantage of algorithmic stablecoins’ lower fees to maximize efficiency. Since these coins are decentralized and less reliant on intermediaries like banks or payment providers, they typically charge lower transaction fees than other digital assets. As such, investors can lower their expenses while still taking full advantage of algorithmic stablecoins’ potential benefits.

Finally, take into consideration the technical specifications when selecting an algorithmic stablecoin for your portfolio. Algorithmic stablecoins vary in terms of blockchains used (Ethereum or Tron) or consensus mechanisms employed (Proof-of-Stake or Proof-of-Work). Investors should understand these underlying technologies in order to make an informed decision when choosing an algorithmic stablecoin.

These practical steps will help investors unlock the potential of algorithmic stablecoins and revolutionize their crypto portfolios. By carefully selecting a reliable provider, assessing performance and stability, diversifying their portfolios, managing risk effectively, taking advantage of lower fees, and considering technical specifications, investors can take full advantage of the opportunities offered by algorithmic stablecoins.

Conclusion

In conclusion, algorithmic stablecoins are an exciting new asset class with a range of potential benefits for those looking to revolutionize their crypto portfolio. By taking advantage of the increased liquidity and reduced slippage that algorithmic stablecoins offer, as well as managing risk and increasing returns through diversification, investors can unlock the potential of these powerful assets. With the right knowledge, practical steps, and strategic approaches, algorithmic stablecoins can help you reach your goals and gain long-term success in the crypto market.

Investors should focus on understanding how algorithmic stablecoins work and the advantages they offer. Researching existing projects and gaining insight into how they operate is essential if you are planning to capitalize on the potential of this asset class. Additionally, it’s important to remember that even with increased liquidity, there is still a degree of risk associated with investing in crypto assets. As such, investors should ensure they fully understand the risks involved before committing funds. Finally, investors must exercise caution when choosing which algorithmic stablecoins to invest in to ensure that they are receiving value in return for their investment.

Ultimately, algorithmic stablecoins represent an exciting opportunity for investors looking to add stability, diversification, and potential returns to their portfolios. By taking the time to research available options and develop a sound strategy for managing risk and maximizing returns, investors can unlock the potential of this revolutionary asset class and achieve long-term success in the crypto space.

Algorithmic stablecoins offer a great potential to revolutionize a crypto portfolio. Their advantages, such as increased liquidity, reduced slippage, and lower fees, provide excellent opportunities to diversify a portfolio, manage risk, and increase returns. By following the practical steps detailed in this article, investors can take advantage of these opportunities and unlock the potential of algorithmic stablecoins.

What are algorithmic stablecoins?

Algorithmic stablecoins are digital assets designed to maintain a stable price by using cryptocurrency algorithms that automatically adjust their supply. They use a variety of methods to keep their value stable, including price feeds, collateralized debt positions, and seigniorage shares. They are typically used to store, send, and trade value without having to worry about price volatility.

Why are algorithmic stablecoins risky?

Algorithmic stablecoins are risky because they are largely unregulated and have not been tested in a live market. Without adequate regulation and oversight, algorithmic stablecoins could be prone to manipulation and market manipulation. Additionally, algorithmic stablecoins could be vulnerable to coding errors that could cause significant price volatility and losses. Furthermore, algorithmic stablecoins may not be backed by any real-world assets, making them more prone to manipulation by those in control of the code.

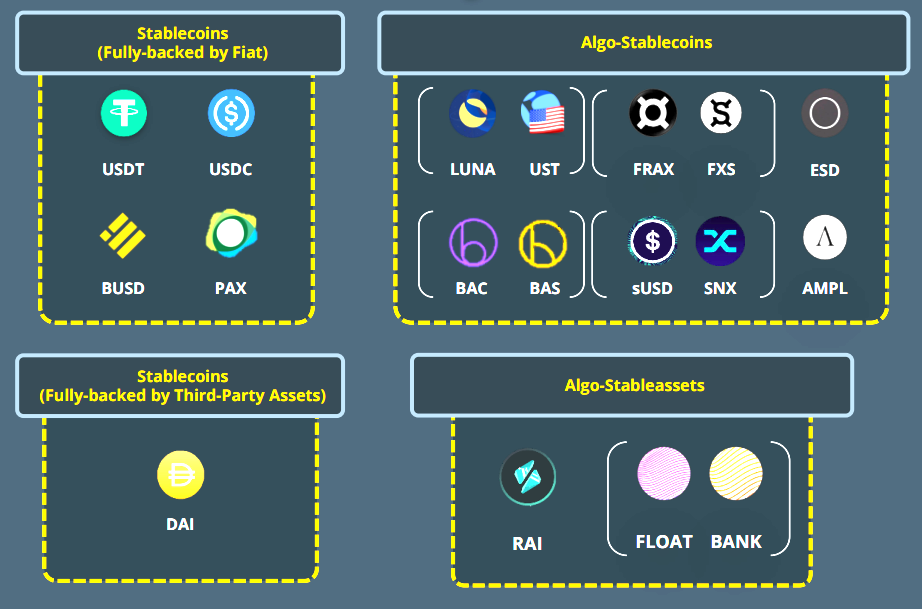

What is algorithmic stablecoin vs stablecoin?

Algorithmic stablecoins are digital assets designed to maintain a stable value by using a combination of algorithms and underlying collateral. They are typically backed by a basket of assets and their value is managed by a set of rules and protocols. The goal of algorithmic stablecoins is to maintain the same value over time and to be free from external influences like political or economic events, or the devaluation of fiat currencies.

Stablecoins, on the other hand, are digital assets designed to maintain a stable value through the use of collateral. They are typically backed by a reserve of fiat currency, a basket of assets, or other digital assets. The goal of stablecoins is to maintain a stable value by pegging it to the value of the assets or the fiat currency reserves that back it.

What are the 3 types of stablecoins?

1. Fiat-backed Stablecoins: These are stablecoins that are backed by a reserve of fiat currency, such as the US Dollar, Euro, or any other fiat currency. This reserve is held in a bank and is usually audited regularly to ensure that it is always at the correct amount.

2. Cryptocurrency-backed Stablecoins: These are stablecoins that are backed by a reserve of another cryptocurrency, such as Bitcoin or Ethereum. This reserve is held in a smart contract and is also regularly audited to ensure it is always at the correct amount.

3. Commodity-backed Stablecoins: These are stablecoins that are backed by a reserve of a physical commodity, such as gold or silver. This reserve is held in a vault and is also regularly audited to ensure it is always at the correct amount.

How Does Stablecoin Work?

Stablecoins are a type of cryptocurrency that is designed to maintain a stable value. They are typically backed by a reserve asset, such as fiat currency, gold, or other cryptocurrencies. This backing helps to maintain the stablecoin’s value and prevent it from being subject to the same volatility as other cryptocurrencies. Stablecoins can be used to facilitate transactions, store wealth, and even act as an alternative to fiat currency when making payments.

What Is the Purpose of Stablecoin?

Stablecoins are cryptocurrencies designed to maintain a stable value against a specific asset. They aim to solve the problem of cryptocurrency volatility by providing the benefits of blockchain technology with a stable store of value. They are typically used as a means of payment, as a unit of account, and as a form of collateral. Stablecoins can also be used to facilitate international transactions and reduce the cost of cross-border payments.

Is UST an algorithmic stablecoin?

No, UST is not an algorithmic stablecoin. UST is a token-based stablecoin created by the U.S. Treasury. The token is backed by the full faith and credit of the U.S. government, and is designed to offer a stable store of value and a safe haven for investors.