Puerto Rico has taken a big leap forward in the cryptocurrency and blockchain industry with the introduction of its Act 60. The Department of Economic and Commerce Development (DDEC) recently issued a document outlining the rules for blockchain companies to receive tax benefits from the state. This groundbreaking action is aimed at providing an environment of certainty and stability to blockchain firms, allowing them to expand their operations in Puerto Rico. DDEC Secretary Luis Cidre has expressed his support for this initiative and its potential to benefit both the state’s economy and blockchain-related businesses. In this article, we will explore how Puerto Rico’s Act 60 defines tax exemptions for blockchain companies.

Puerto Rico’s Act 60

In an effort to encourage blockchain businesses to establish operations in its U.S. territory, Puerto Rico’s Economic and Commerce Development Department (DDEC) recently issued a regulatory framework outlining conditions for tax exemptions. The new rules are a part of the Act 60, which is aimed at spurring economic development in the island by offering incentives for blockchain companies to settle there. Speaking about the decision to issue the Act 60, Manuel Cidre, Secretary of DDEC, said that it was necessary for them to be proactive in addressing the technology and its potential for economic activity.

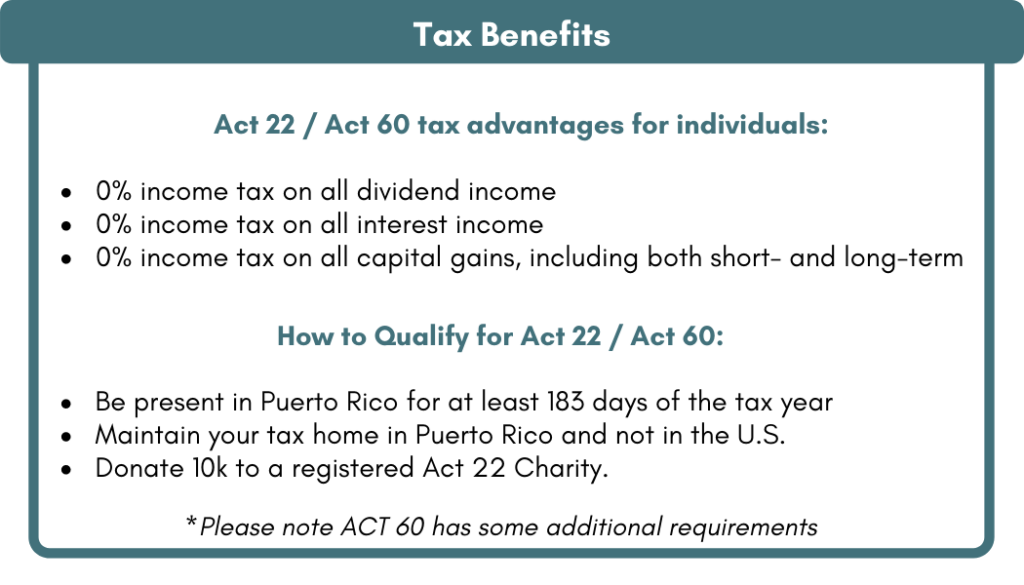

The Act 60 offers many perks for blockchain businesses, such as lower corporate tax rates and no taxes on foreign income. It also grants businesses exemptions from capital gains and long-term profits taxes. Companies can also benefit from Puerto Rico’s strong infrastructure and well-educated workforce. Furthermore, they will have access to the Puerto Rican Blockchain Hub, a collaborative space dedicated to promoting business innovation and fostering blockchain-related activities.

The goal of Act 60 is to make Puerto Rico an attractive destination for blockchain companies by encouraging them to set up operations there and take advantage of the tax exemptions available. It is also hoped that the influx of businesses will stimulate the economy and create jobs for local residents. If successful in its mission, Puerto Rico will be able to benefit from the economic activities created by the blockchain industry while providing a haven of opportunity for the companies who choose to settle there.

Puerto Rico’s Act 60 – Pioneers of Blockchain Regulations and Taxation

Puerto Rico is establishing definitions for blockchain-related services in order to provide an accurate legal framework and receive exemption for tech exporters. The government is actively working to make Puerto Rico an attractive location for blockchain companies. In June 2020, Act 60 was signed into law by Governor Wanda Vázquez Garced, becoming the first US jurisdiction to define certain types of tokens and their tax implications. This act sets forth a legal definition of blockchain-related activities and services, as well as rules regarding taxation. Keiko Yoshino, executive director of the Puerto Rico Blockchain Commerce Association, commended the effort: “We are thrilled with the modernized regulations established in Act 60 that will help create clarity and certainty in an ever-evolving industry while preserving Puerto Rico’s competitive edge.”

Act 60 has outlined some of the nuances around cryptocurrency elements in Puerto Rico. For example, virtual currencies are not considered legal tender in the territory. While cryptocurrencies are not subject to taxation, exchanges and other services related to them are subject to sales tax. Additionally, mining activities are exempt from taxation until 2023. Moreover, a proposed reform to the “Sales and Usage Tax” includes NFTs as taxable assets.

In summary, Puerto Rico has taken steps towards defining blockchain-related services and setting forward rules regarding taxation. Through its efforts, the government is hoping to make Puerto Rico an attractive location for technology companies by providing a clear and straightforward framework for their operations. Act 60 sets out a comprehensive set of regulations that provide clarity and certainty while helping maintain Puerto Rico’s competitive edge in this ever-evolving industry.

In conclusion, Puerto Rico’s Act 60 is a pioneering set of regulations that provide blockchain companies with generous tax exemptions while assessing a reasonable tax rate on their profits. By creating a favorable tax environment, this legislation has already attracted many blockchain companies to the jurisdiction, further stimulating the local economy and creating more job opportunities. For those looking to capitalize on blockchain technology with the attractive tax incentives offered by Puerto Rico, Act 60 is the key to unlocking their potential.