Segregated Funds

Segregated funds, also known as segregated investment accounts or segregated asset accounts, are a type of mutual fund that is legally separated from the other assets and liabilities of the fund’s issuer. Segregated funds provide protection for investors against loss due to mismanagement of the fund’s portfolio by segregating investments according to their respective categories. This allows investors to have more control over their investments and reduce their risks.

How Do Segregated Funds Work?

Segregated funds work like any other mutual fund in that they pool together money from multiple investors who share a common investment goal. The difference lies in how the investor’s money is held within these pooled funds; it is kept separate from any other assets owned by the issuing company or institution in order to protect it from potential losses due to mismanagement or financial difficulties experienced by its parent organization. Each investor’s capital remains safe even if there were an insolvency event with regards to the issuer, since each individual account would be protected under Canadian law (or similar protections depending on jurisdiction).

Benefits of Investing in Segregated Funds

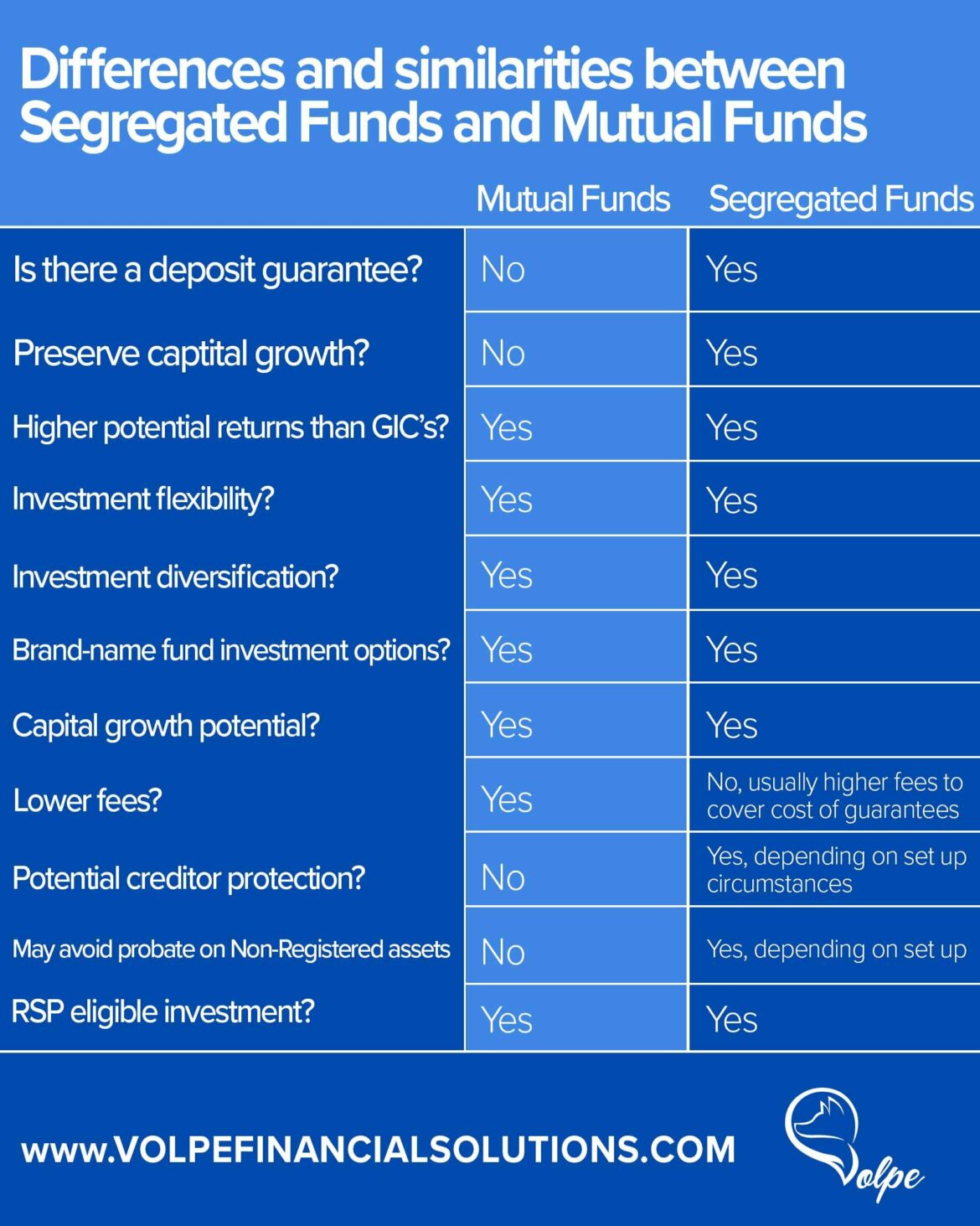

The main benefit of investing in segregated funds compared with directly invested stock markets is greater safety and security for your capital investment. Since all investments are held separately and not part of a larger collective portfolio, they can be managed without risk based on individual objectives and goals while still enjoying many advantages such as tax deferral benefits, estate planning options, life insurance policies linked savings plans (such as variable annuities), etc. Furthermore, this structure makes it easier for investors to diversify into different types of investments since each account requires its own minimum balance which encourages further diversification across different asset classes beyond just stocks/bonds/cash equivalents. Additionally, many insurers provide guarantees on principal amounts plus interest rate returns when investing through segregated accounts so it can also offer peace-of-mind when considering long-term strategies such as retirement income planning or legacy building purposes