Taxes UK Crypto

Cryptocurrency is becoming increasingly popular in the United Kingdom, and as with any financial activity, it is important to understand the tax implications. This article will provide an overview of how cryptocurrency transactions are treated for taxation purposes by HM Revenue & Customs (HMRC) in the UK.

Overview of Tax Treatment

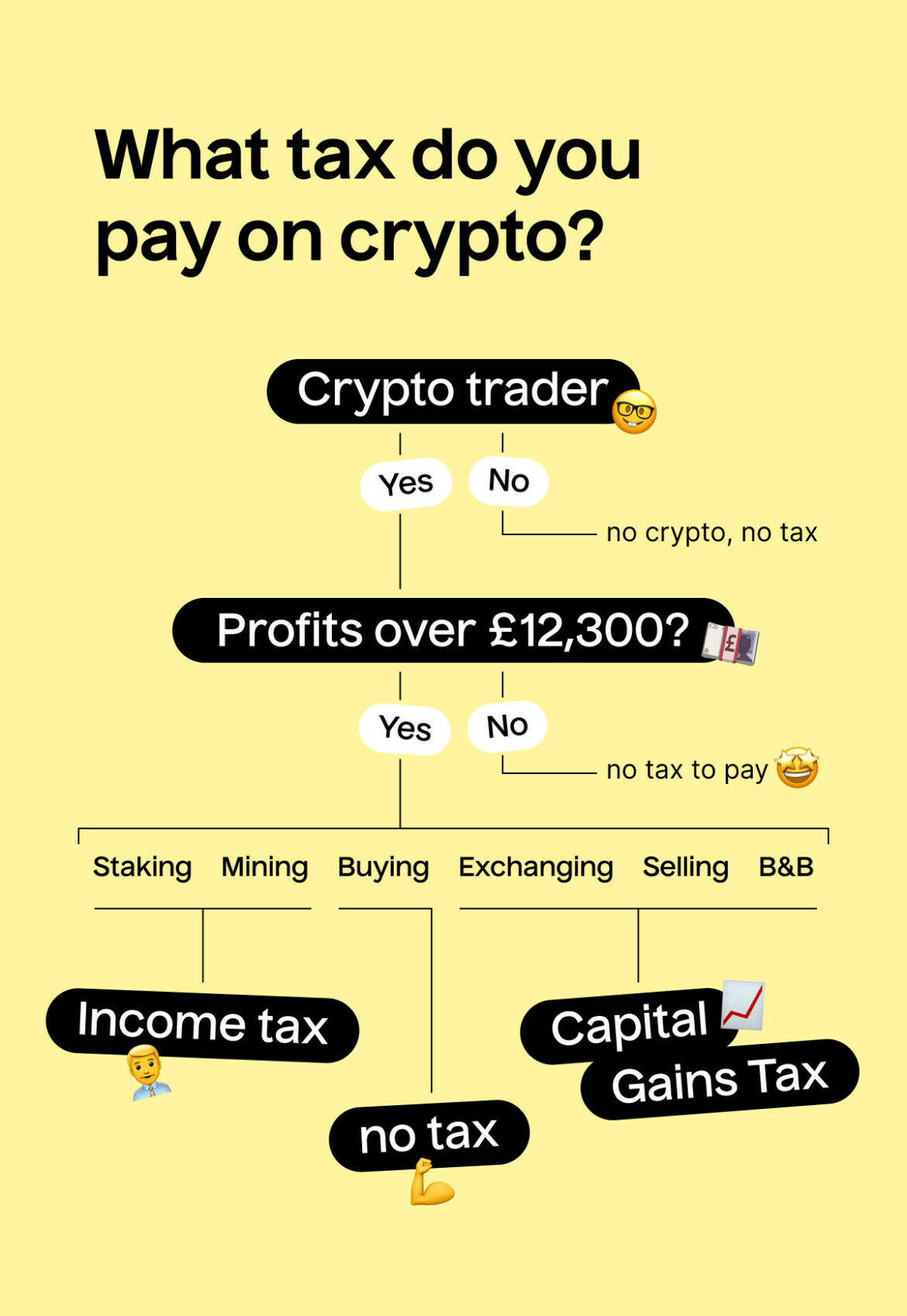

The primary source of guidance from HMRC on digital currency transactions can be found in their policy paper “Exchange Tokens (Cryptoassets): Tax” which was published in December 2018. According to this document, cryptocurrencies are considered a form of property within the scope of Corporation Tax and Income Tax legislation. As such, they may be subject to Capital Gains Tax (CGT), Inheritance Tax or Stamp Duty Reserve Tax depending on how they were acquired and used.

Capital Gains Taxes

If you have made a gain from disposing of cryptoassets then you may need to pay CGT on these gains. The amount payable is based on your income level: basic rate taxpayers pay 10%, higher rate taxpayers 20% and additional rate taxpayers 45%. To calculate your taxable gain you must subtract any allowable costs such as transaction fees incurred when buying or selling cryptoassets from your total proceeds before applying the relevant rate of tax; losses can also be offset against gains if applicable but must still be reported to HMRC via self-assessment returns. Any profits generated through trading activities may also fall under Business Income treatment which could attract different tax rates so it’s important that individuals consider their own situation carefully before making any decisions about taxation liabilities associated with holdings or trades involving cryptocurrency assets.

Inheritance Taxes Inheritance taxes apply when transferring ownership rights over digital tokens upon death; similar rules apply as those for other types of asset where gifts above £325k incur 40% liability for direct descendants and other beneficiaries receiving transfers at market value rather than cost price paying between 0–40%. It’s worth noting however that exemptions exist for certain situations including spouses/civil partners transferring inherited assets between themselves without incurring inheritance taxes due to spousal exemption allowances being applied – further details can be found via gov[dot]uk/inheritance-tax/.

Stamp Duty Reserve TaxesAny purchases / sales involving cryptocurrencies within exchanges located inside the European Economic Area are potentially liable for stamp duty reserve taxes if held overnight due to regulations set out by Her Majesty’s Treasury – more information regarding these requirements along with updated rates should always be checked prior to engaging in such activities accordingly since penalties could otherwise result if not adhered too correctly during operation periods outlined therein [d].

ConclusionIt is clear therefore that there are several potential tax considerations which should always be taken into account whenever dealing with cryptocurrency related investments both professionally or personally whether through long term holds / short term trading strategies etc., so understanding all relevant laws & regulations beforehand remains essential regardless type involved so as not ensure compliance throughout entire process targeted going forward thereafter accordingly