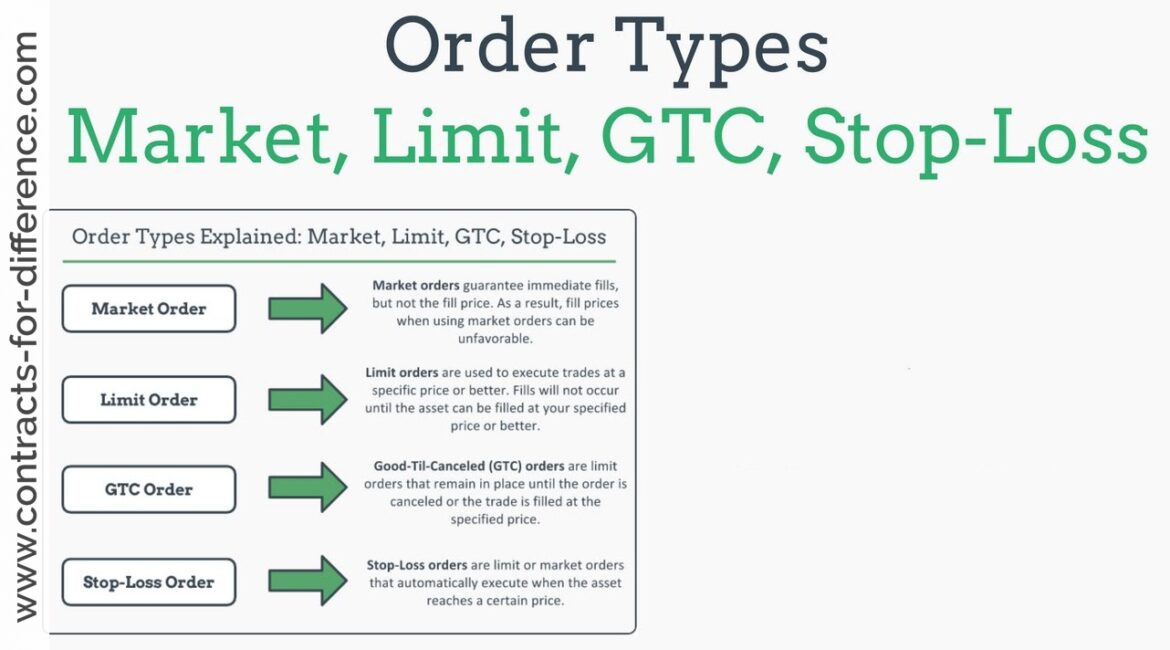

Stop-Loss Order

A stop-loss order is a type of security trading order that helps to minimize investor losses on a position. It is an instruction given by an investor to their broker or brokerage firm to automatically sell the security when it hits a certain price. The purpose of this order is to limit potential losses if the market moves against the investor’s position. This type of order can be used for both long and short positions, but it is more commonly used in long positions where investors want to protect themselves from downside risk.

When placing a stop-loss order, investors need to consider several factors such as volatility, liquidity and execution costs that could affect how much they are willing to lose on any particular trade. In addition, there are different types of stop orders available such as trailing stops, which adjust with market movements; and conditional stops based on specific criteria like time or volume traded.

The main advantage of using stop-loss orders is that they provide protection against unexpected changes in the direction of the market’s movement while giving traders flexibility over their entry/exit points without having constant monitoring or manual intervention required at all times. By setting appropriate limits for each trade you can manage your risk exposure better and reduce potential losses significantly.