What is Moving Average Convergence Divergence (MACD)?

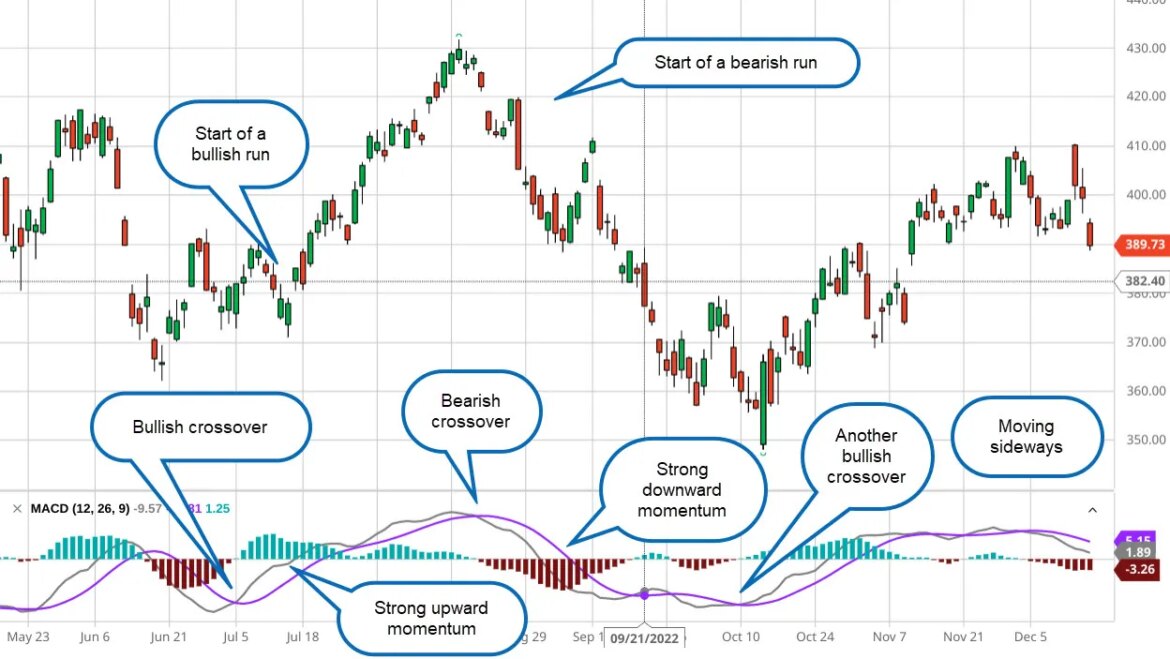

Moving Average Convergence Divergence (MACD) is a popular technical analysis indicator used to identify momentum and trend direction in a given asset. It uses two exponential moving averages, typically the 12-day EMA and the 26-day EMA, to detect changes in an asset’s momentum. The MACD line is the difference between these two EMAs, while the signal line represents a 9-day EMA of the MACD line. Crossovers between these two lines are used as potential buy or sell signals for trading strategies. Additionally, divergences between price action and MACD can also be observed as potentially significant events in an asset’s overall trend direction.