Flash Loan Attack

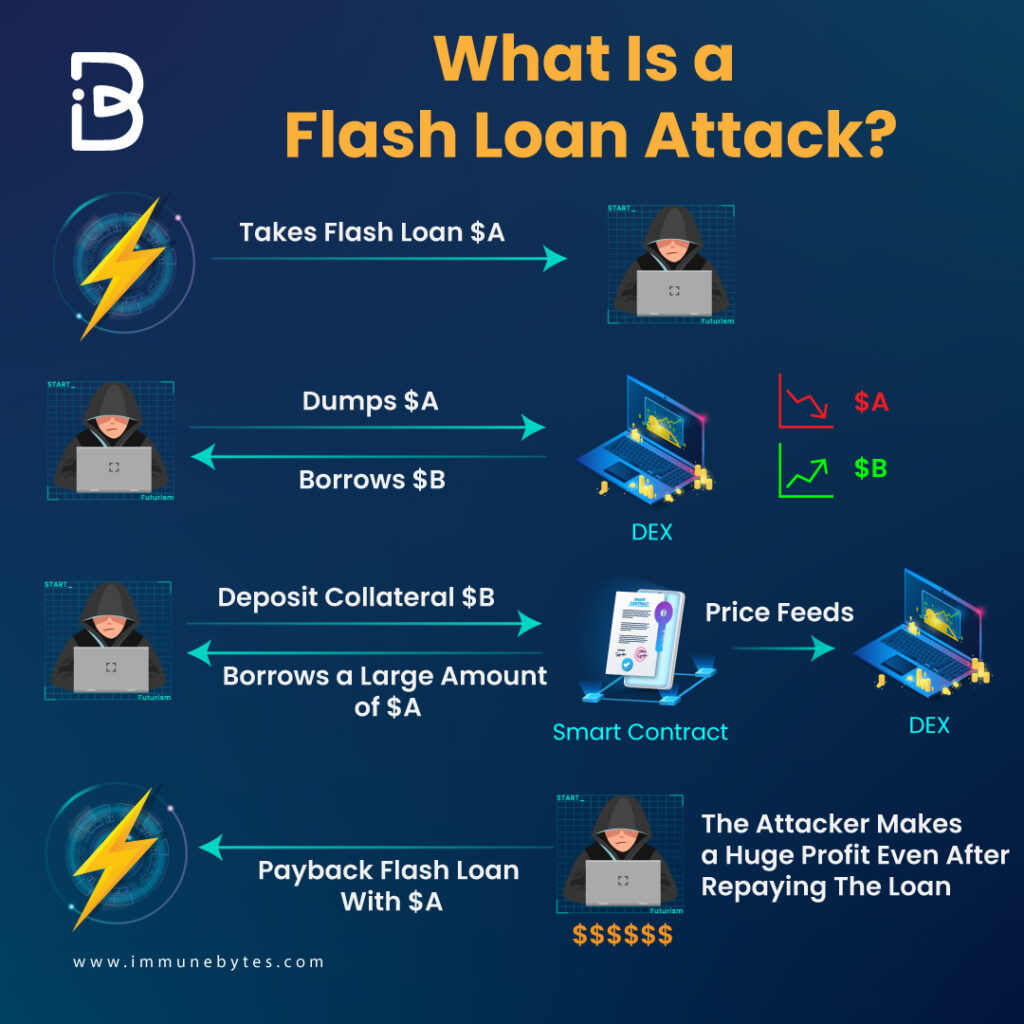

A flash loan attack is a type of exploit in the cryptocurrency world. It involves taking out an extremely short-term loan and using it to take advantage of pricing discrepancies between different exchanges or platforms, often for profit. These attacks are made possible by so-called “flash loans” which provide users with temporary access to funds without requiring any collateral.

The concept of flash loans was introduced in 2018 as part of the DeFi (Decentralized Finance) movement, where developers built innovative financial products on top of existing decentralized networks such as Ethereum. The idea behind these types of loans is that they allow users to borrow money quickly and easily, without having to go through the traditional process that would usually be associated with obtaining a loan from a bank or other lending institution. This convenience comes at a cost though – if not used correctly, flash loans can present significant risks both for lenders and borrowers alike due to their highly volatile nature.

Flash loan attacks become possible when two conditions are met: 1) there must be enough liquidity available on both sides of the transaction; 2) there must be some kind of arbitrage opportunity between two markets or platforms which allows profits to be made off the trade itself rather than relying solely on borrowing fees paid back by the borrower when repaying their debt. Once these conditions have been met, an attacker can then take out a large amount (often millions) in one single “flash” transaction, use this borrowed capital immediately for trading purposes and then repay it before interest accrues – all within seconds! Depending upon how successful this initial trade is, attackers may repeat this process multiple times until either they have reached their desired level or profits/risks have become too high .

An example scenario could involve purchasing tokens from one exchange at very low prices and selling them on another exchange at much higher ones – essentially profiting from price differences between different markets despite having no underlying capital invested themselves! Although many believe that flash loan attacks will eventually become less common due to increased security measures taken by various exchanges , currently they remain one area that investors should watch out for when dealing with cryptocurrencies as well as participating in new DeFi projects involving flash loans.