Accrued Income Definition

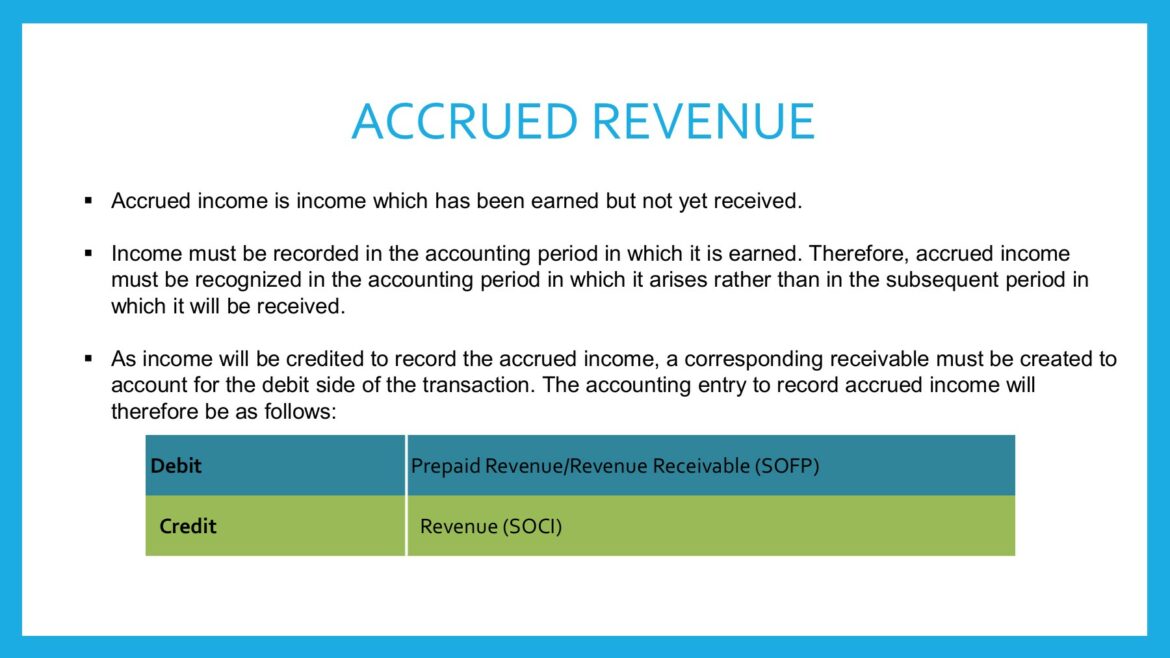

Accrued income is the income that a business has earned but has not yet received in cash. It is also known as accrued receivables or accrued liabilities, and it represents money that is owed to the company by its customers for services rendered. Accrued income can take many forms, including interest payments on loans or investments, rent payments from tenants, or unpaid invoices from suppliers.

Reporting of Accrued Income

The reporting of accrued income varies depending on accounting standards and practices. Generally speaking, companies report their accounts receivable (accrued income) at their net realizable value – meaning they deduct any allowance for doubtful debts when calculating how much revenue they will actually receive in cash. For example, if a company had $1 million in accounts receivable but estimated that 10% of those invoices were unlikely to be paid due to customer insolvency or other factors then it would record only $900 thousand as its net realizable value for this period’s revenue reports.

Taxation Of Accrued Income

Income taxes are usually paid on all forms of earned revenue regardless if it has been received in cash or not; however taxation laws may vary depending on location and jurisdiction so consulting with an accountant regarding your specific situation is recommended before filing your tax returns. In addition some countries allow businesses to defer paying taxes until such time as the accrued incomes have been collected; again check with local regulations prior to making any decisions about taxation related matters involving accrued incomes.

Importance Of Monitoring And Managing Accruals

Monitoring and managing accruals are important aspects of running a successful business since these funds represent future profits which could be used towards investing into new projects or expanding existing ones within a company’s portfolio; therefore having accurate records and understanding where potential risks lie within one’s balance sheet helps ensure prudent measures are taken throughout all stages of operations while keeping liquidity maintained at desired levels during periods when revenues decline unexpectedly due unforeseen circumstances beyond control such as global economic downturns etc..