U.S. Benchmark Stock Indexes

A benchmark stock index is a measurement of the performance of certain stocks in a given market, typically used to gauge the overall health of that particular market. In the United States, there are several different indexes that serve as benchmarks for the stock markets, giving investors an indication of how well each sector is performing and providing insight into areas where further investment may be beneficial. Here we will look at some of the major U.S. benchmark stock indexes:

• Dow Jones Industrial Average (DJIA): The DJIA is one of the oldest and most widely-followed stock market indices in existence, consisting of 30 large publicly traded companies on average trading on either the New York Stock Exchange or Nasdaq Composite Exchange. It provides investors with an overview of how these 30 blue-chip companies have been performing over time and can often act as a bellwether for other markets around it; if these companies are doing well then it’s likely that their respective sectors may be following suit too!

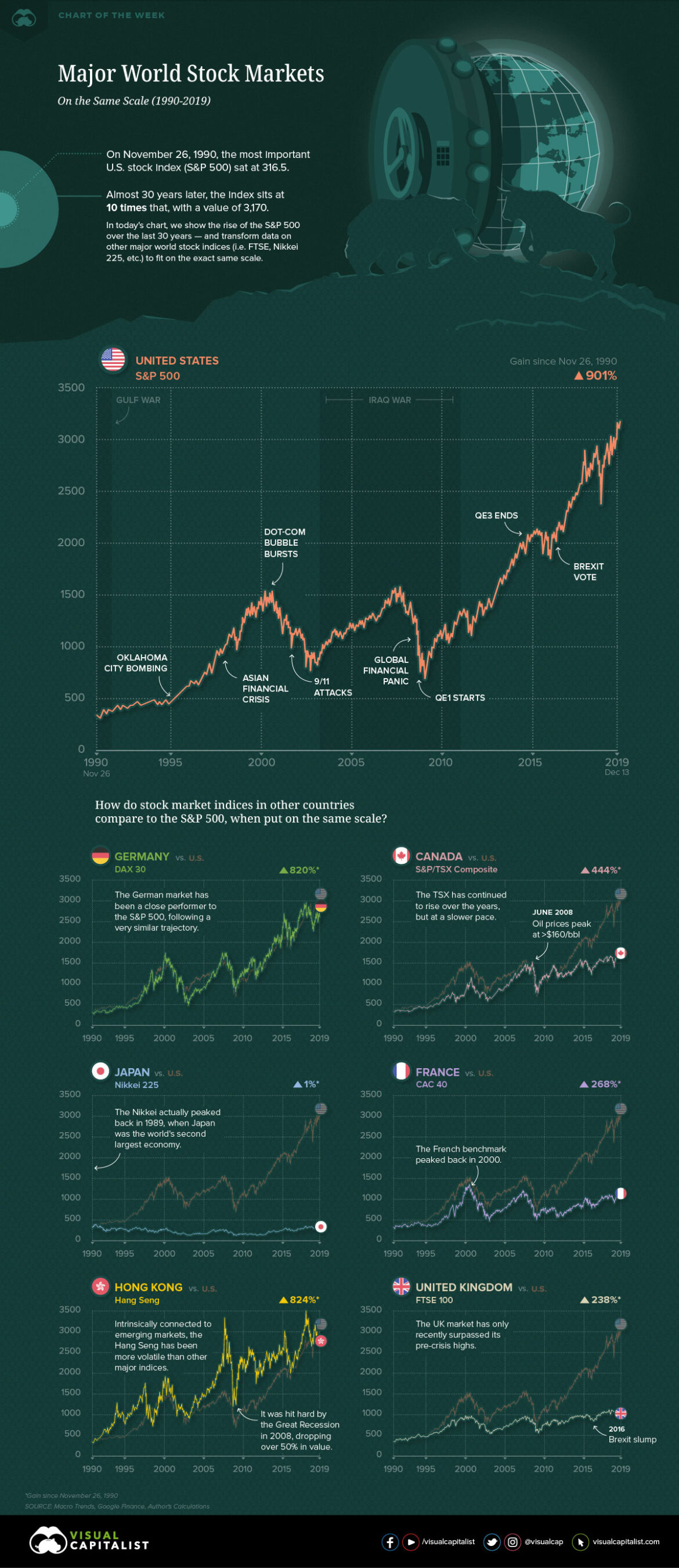

• S&P 500: Often referred to simply as ‘the S&P’, this index consists of 500 large cap company stocks from 11 different sectors across all three major exchanges – NYSE, Nasdaq and AMEX – making it one wider than both its predecessor mentioned above and arguably more representative when looking at US equities performance overall; however due to its size many argue it can also be less representative compared to smaller indices like those below which track fewer stocks but still accurately reflect what’s going on within specific industries / sectors respectively..

• NASDAQ Composite: This index includes all common stocks listed on The NASDAQ Stock Market including international corporations such as Apple Inc., Microsoft Corporation etc., plus any American Depositary Receipts (ADRs). Due to its heavy tech focus, this index tends to move faster than other broader based indices like DJIA or S&P500 due mainly because technology changes so quickly – particularly in today’s digital economy – meaning any good news about advances/innovations etc related directly towards IT/Tech firms tend show up quicker here rather than elsewhere!

• Russell 2000 Index: As opposed larger indices discussed above which contain hundreds or even thousands individual components (like S&P 500), this relatively small-cap focused version tracks only 2K US publically traded companies ranging from micro caps through mid caps – thus making it ideal for tracking themes such small business sentiment / regional trends etc…