Two-Year Treasury Yield

The two-year Treasury yield is a measure of the return on investment (ROI) for U.S. government bonds with a maturity of two years or less. This rate is determined by the U.S. Department of the Treasury, which sets interest rates in order to manage economic growth and inflation levels in the country.

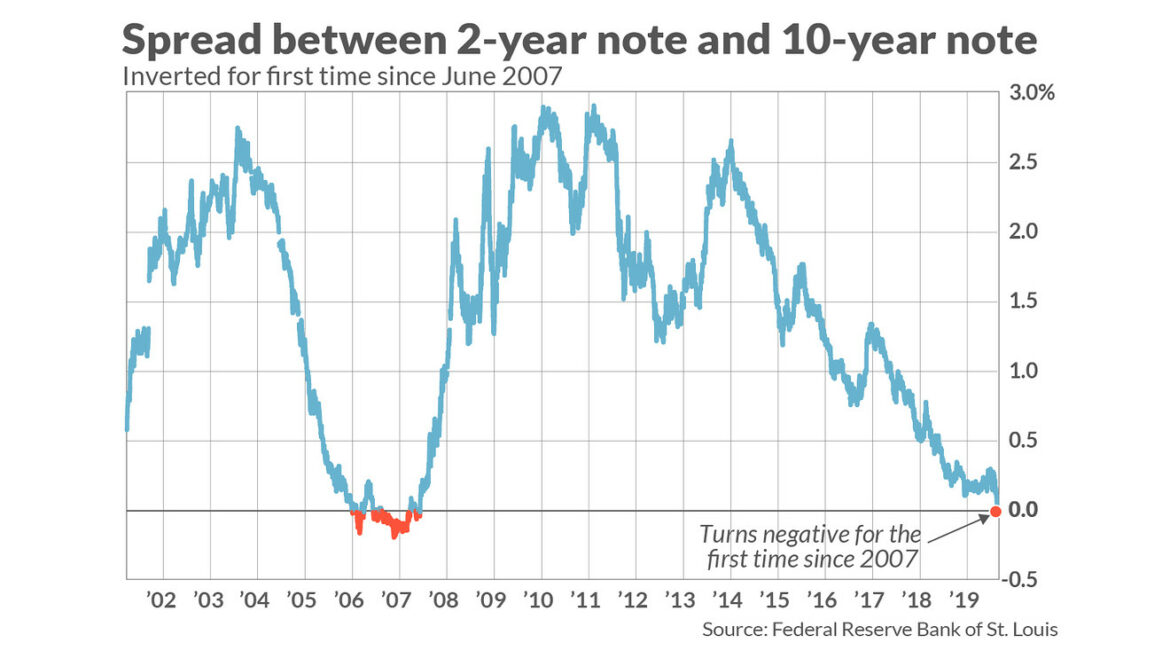

The two-year treasury yield can be used as an indicator for gauging overall market sentiment about future economic conditions and expectations about short term interest rates set by central banks such as the Federal Reserve Bank of United States (the Fed). Generally speaking, when investors expect higher inflation or faster economic growth, they will demand higher yields from their investments and this drives up prices for debt securities like treasuries; conversely, when investors expect slower growth and lower inflation, bond prices will drop resulting in lower yields on these instruments.

Changes in the two-year treasury yield can also have indirect effects on other financial markets such as stocks and cryptocurrencies due to changes in anticipated future interest rate policies set by central banks like The Fed or European Central Bank (ECB). As such it is important that investors pay close attention to movements in this rate since they may indicate shifts occurring within larger macroeconomic forces that could potentially impact their portfolios.