UK Taxes

Cryptocurrency is a digital currency that exists only in the virtual world, and as such it can be difficult to understand how taxes work when dealing with these types of currencies. In the United Kingdom, cryptocurrency gains are subject to taxation just like any other type of income or capital gain. The specifics of tax on cryptocurrency depend on each individual’s circumstances, but guidance has been published by Her Majesty’s Revenue & Customs (HMRC) for taxpayers who need help understanding their obligations.

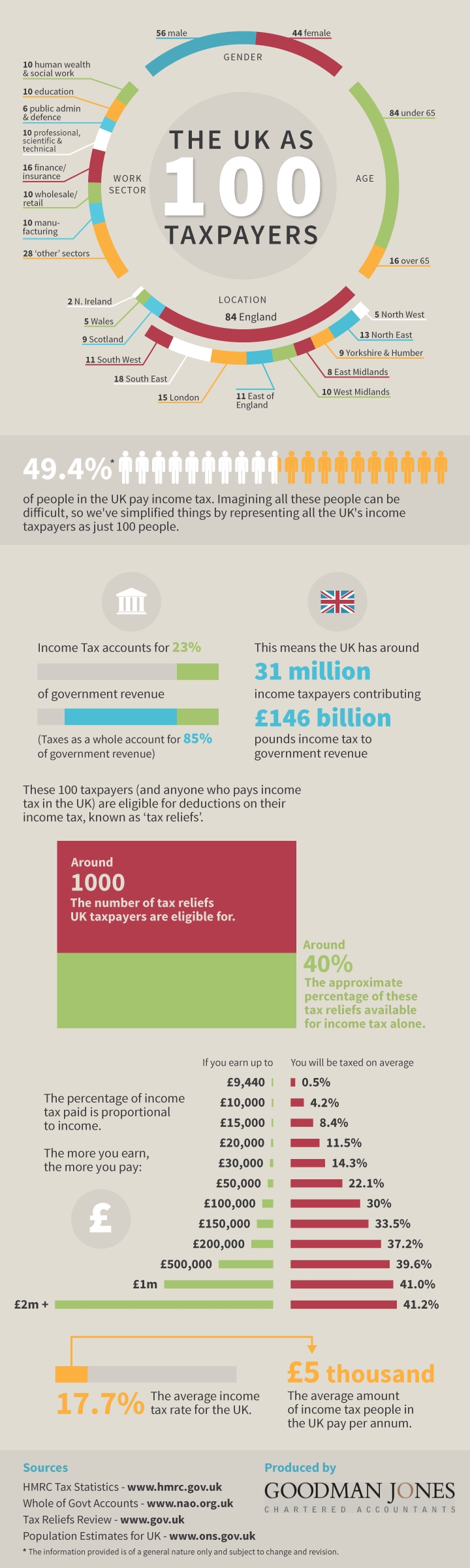

Income Tax: Any money made from trading in cryptocurrencies will count as taxable income and must be reported to HMRC. This includes profits made from buying and selling cryptocurrencies as well as any rewards earned through staking or mining activities. It also applies to anyone receiving payments in cryptoassets for goods or services provided – this could include freelance jobs paid in cryptocurrency, for example. HMRC considers all forms of cryptoasset activities earning an “income” rather than a “capital gain” so they should be reported via self-assessment tax returns alongside other sources of income like wages or rental earnings etc..

Capital Gains Tax: If your total capital gains exceed £12,300 then you must pay Capital Gains Tax (CGT). Cryptocurrencies are treated differently depending on whether they meet certain criteria set out by HMRC – if they do then CGT may be payable when disposing them; otherwise Income Tax rules apply instead (as outlined above). Specifically, cryptos fall into one of three categories according to what type they are and how long you have held them: Excluded Property; Personal Investment; Business Asset – each has different guidelines related to CGT calculation which investors should consider carefully before disposing assets within these categories.

Stamp Duty Reserve Tax: Generally speaking Stamp Duty Reserve Tax (SDRT) does not apply to transactions involving cryptocurrencies since SDRT only relates to shares listed on a stock exchange recognized under UK law – however there is one exception where SDRT applies if the purchase involves derivatives contracts based upon certain specified indices which includes some cryptoassets related indices e.g., Crypto 10 Index Contract For Differences products traded at regulated exchanges may trigger SDRT liability so it’s important that traders check relevant terms carefully before entering into trades involving these products.

Value Added Tax: As per current EU regulations, Value Added Taxes (VAT) do not apply when buying/selling Bitcoin directly between two parties however VAT does become due if services such as brokerage fees or storage costs are involved – this means that businesses providing such services for customers who buy/sell Bitcoin will likely need an appropriate VAT registration number issued by HMRC in order for those customers’ transactions not incur additional charges due VAT liabilities being added onto invoices etc..