Pegged Currency

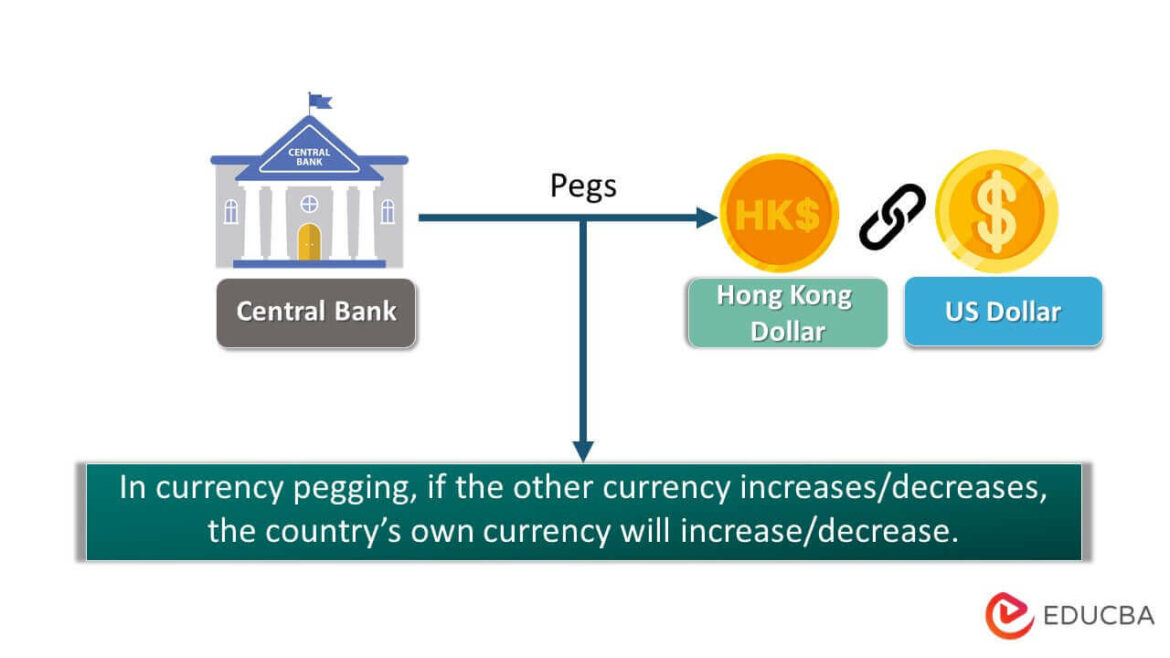

Pegged currency is a type of exchange rate regime used by central banks to maintain the value of a particular currency relative to another. Pegging allows governments and monetary authorities to influence their domestic economy and international trade, as well as providing stability for foreign investors. It also helps countries avoid situations where inflation or deflation could lead to economic instability.

In this system, the government sets an official rate at which its currency can be exchanged with another country’s money; any deviation from this rate must be approved by the government in order for it to take effect. This rate is usually set according to market conditions and changes over time depending on those conditions, but it remains fixed unless the government decides otherwise—hence the term “pegged”.

The ability of pegged currencies has increased significantly since the introduction of electronic trading platforms. These systems allow traders from different countries around the world to buy and sell currencies quickly without having to go through lengthy procedures such as exchanging physical notes or coins or going through financial institutions like banks and brokers who may charge additional fees for services rendered. Furthermore, these trading platforms are often available 24/7 so that users can take advantage of market opportunities whenever they arise regardless of location or time zone differences.

There are several advantages associated with using pegged currencies:

-They provide stability in terms of prices because fluctuations in exchange rates don’t occur suddenly overnight; – They help protect businesses against sudden shifts in foreign exchange markets; -They make imports cheaper due to reduced transaction costs associated with conversions between currencies;-They reduce risk when conducting international transactions since there is less uncertainty about future exchange rates;-And they facilitate trade agreements between two countries whose economies differ greatly (for example, if one country’s currency was much weaker than another).

However, there are also some drawbacks associated with pegging: -It eliminates competitive devaluation options which may be beneficial under certain circumstances;-It limits policy flexibility during times when changing interest rates might benefit an economy more than maintaining a peg would do – something known as Dutch Disease;-The cost involved in setting up a peg can outweigh potential benefits if done incorrectly (particularly for small economies);-Governments have been known occasionally abuse pegging mechanisms by manipulating them without regard for economic fundamentals– leadingto misallocations within their own economy.; Finally, pegged currencies tend not require daily maintenance from central banks meaning that longterm effects can become difficult tor predict or control down road should new external shocks arise impacting markets suddenly (e g high oil prices etc).