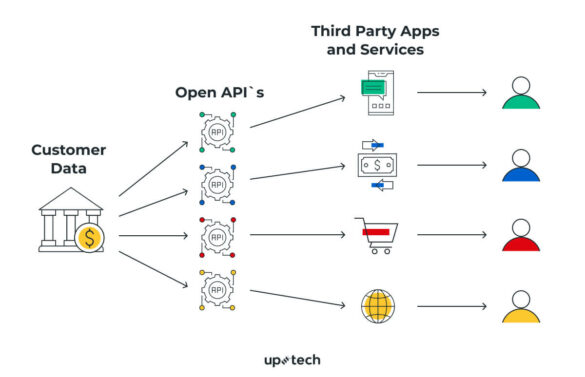

Open Banking is a financial technology (fintech) that enables consumers to access their banking data and transfer money between banks. It allows third-party providers, such as fintech companies, to offer services based on this data. Open Banking also facilitates real-time payments across different payment systems without relying on traditional intermediaries like banks or card networks.

Open banking has become increasingly popular in recent years due to its ability to improve customer experience by providing more transparency and control over their finances. Additionally, it helps reduce costs for both customers and businesses since there are no intermediary fees associated with open banking transactions. Furthermore, open banking can provide greater security since all of the user’s financial information stays within the system instead of being shared with multiple parties outside of the network.

The most common use cases for open banking include online shopping or peer-to-peer payments where customers can make payments directly from their bank accounts rather than having to enter credit card details every time they want to purchase something online. Additionally, some banks have started offering account aggregation services which allow users to view all of their accounts in one place regardless of which institution they belong too – this eliminates the need for customers to manually log into each individual bank’s website just check balances or review transaction history.

In order for an organization or business entity wanting utilize open banking technologies must first become certified under established regulatory requirements such as PSD2 (Payment Services Directive 2). This directive requires institutions that handle large amounts of customer funds adhere strict standards when it comes handling personal data securely transmitting these funds electronically via APIs (Application Programming Interfaces). In addition any company seeking certification must be registered with relevant authorities in order prove its compliance standards are met before they can begin operating legally within Europe’s EEA (European Economic Area) region .