# Limit Order

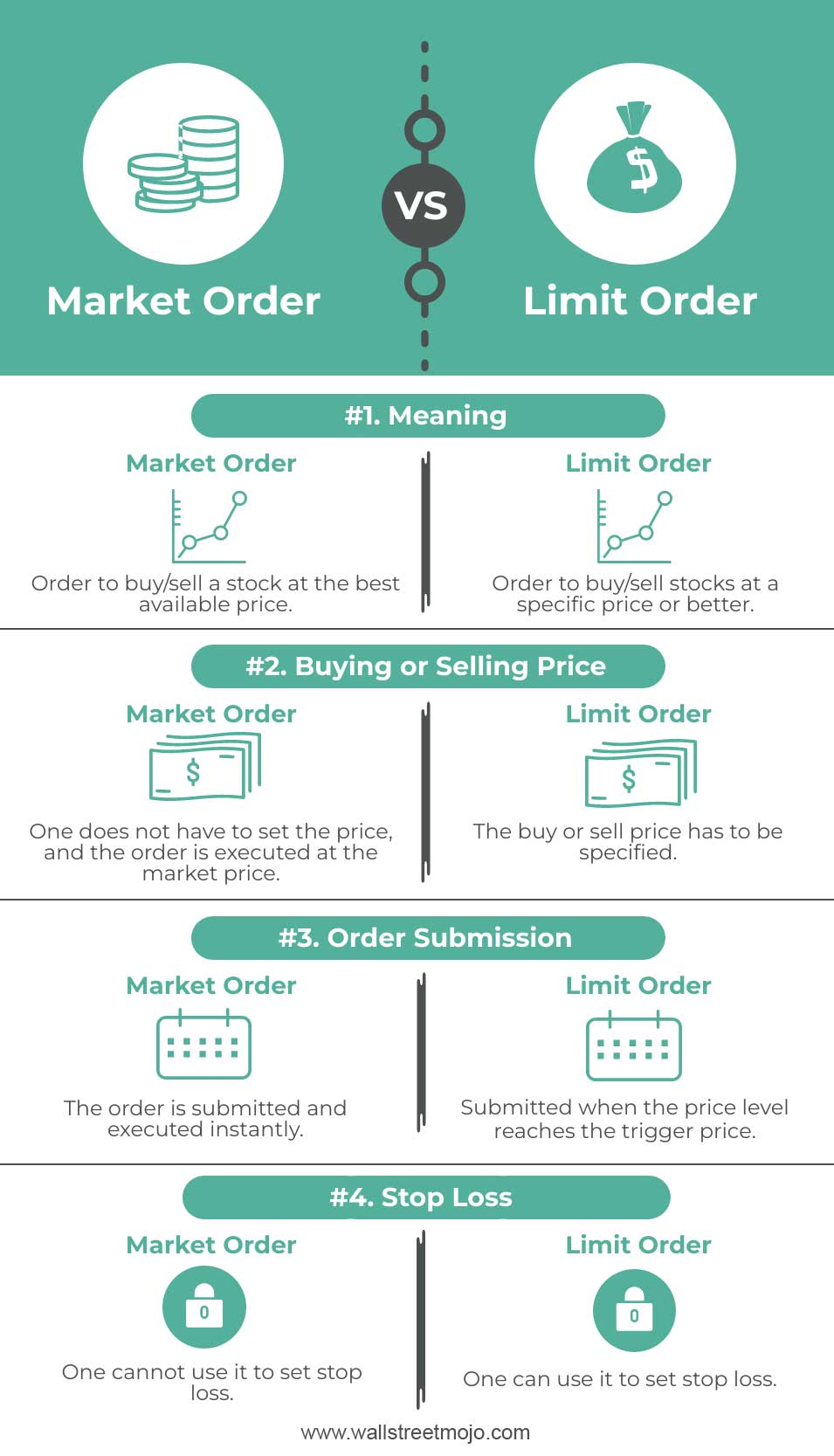

A limit order is a type of order used in trading exchanges, such as those found in the cryptocurrency market. It allows traders to set a specific price at which they are willing to buy or sell an asset. If the current market price does not match the specified amount, then the trade will not go through until it reaches that level. Limit orders can be used to take advantage of short-term fluctuations in prices, protect against sudden losses due to volatility and help manage risk by limiting potential losses on trades.

When placing a limit order, there are two important parameters you will need to enter: The “price” field specifies how much you want your desired asset(s) for each unit; while the “amount” field specifies how many units you want. In other words, if you want 2 BTC at $4000 each –then your price would be $4000 and your amount would be 2 BTC (or 2000 USD).

In addition, when setting up a limit order traders have two options: either going long (buying) or going short (selling). Going long means buying an asset with expectation that its value will increase over time; whereas going short means selling an asset with expectation that its value will decrease over time. For example, if Bitcoin is currently trading for around $5200 but I think it’s likely to drop down to $5000 soon –I might place a limit sell order for 2 BTC at $5000 so I can profit from this expected drop in price without needing constant monitoring of Bitcoin’s rate movements.

Once placed on the exchange platform and accepted by the matching engine -limit orders remain open until they are either partially filled or completely filled depending on whether there is enough liquidity available in the marketplace–in which case they become executed trades and funds adjust accordingly between buyer/seller accounts within seconds–or else expire after some period of time if no suitable counterparties could be found within given timeframe.

Limit orders offer advantages such as allowing users more control over their entry/exit points into positions than traditional market orders do; however it also comes with certain drawbacks associated with them like slippage risk during periods of high volatility when prices may move faster than anticipated causing trader’s intended fill rate getting exceeded before his/her desired stop loss point gets triggered resulting in higher-than-expected losses incurred on trades –which makes timing & placement even more critical factors here than usual making sure traders aren’t leaving money on table due lack thereof!