Collateralized Debt Position (CDP)

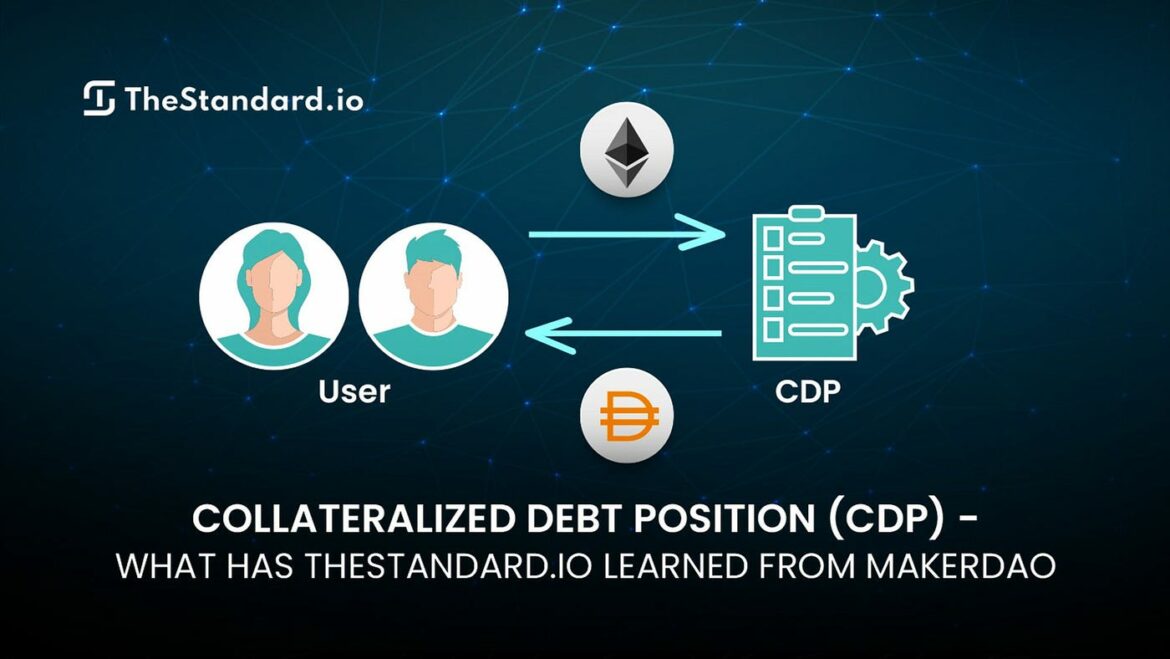

A Collateralized Debt Position, or CDP, is a financial instrument used to collateralize debt. This type of instrument involves the use of assets such as stocks, bonds, and other forms of investment as security for loans. It can also involve using commodities like gold and silver in order to back up a loan agreement. By using these types of collateral as security for the loan, it reduces the risk associated with lending money and allows lenders to be more willing to provide financing at lower interest rates than would otherwise be available without a CDP in place.

In addition to providing increased access to capital at lower costs through its reduced risk profile, CDPs are also used by borrowers who want greater control over their debts by having more options when it comes to repayment terms or refinancing possibilities down the road. A borrower may choose between two primary methods when setting up a CDP: either an open-ended arrangement that allows full repayment flexibility or a closed-end option which requires that all funds must be paid back on predetermined terms before any new borrowing can take place. Depending on their individual needs and preferences, different borrowers will opt for one method over another depending upon their specific circumstances.

When setting up a CDP investors should keep several things in mind: firstly they need to understand what type of securities will serve as suitable collateral; secondly they need evaluate whether there is sufficient liquidity among those investments so that they can easily liquidate them if necessary; thirdly it’s important consider how much debt should actually be taken out against each asset class; finally investors need ensure that all legal requirements related the setup have been fulfilled properly prior entering into any contract agreements with lenders.

Overall Collateralized Debt Positions offer both borrowers and lenders an attractive way manage risks while taking advantage of attractive cost savings due improved liquidity conditions offered under this type financial arrangement – but only if setup correctly from start!