Collateralized Debt Obligation (CDO)

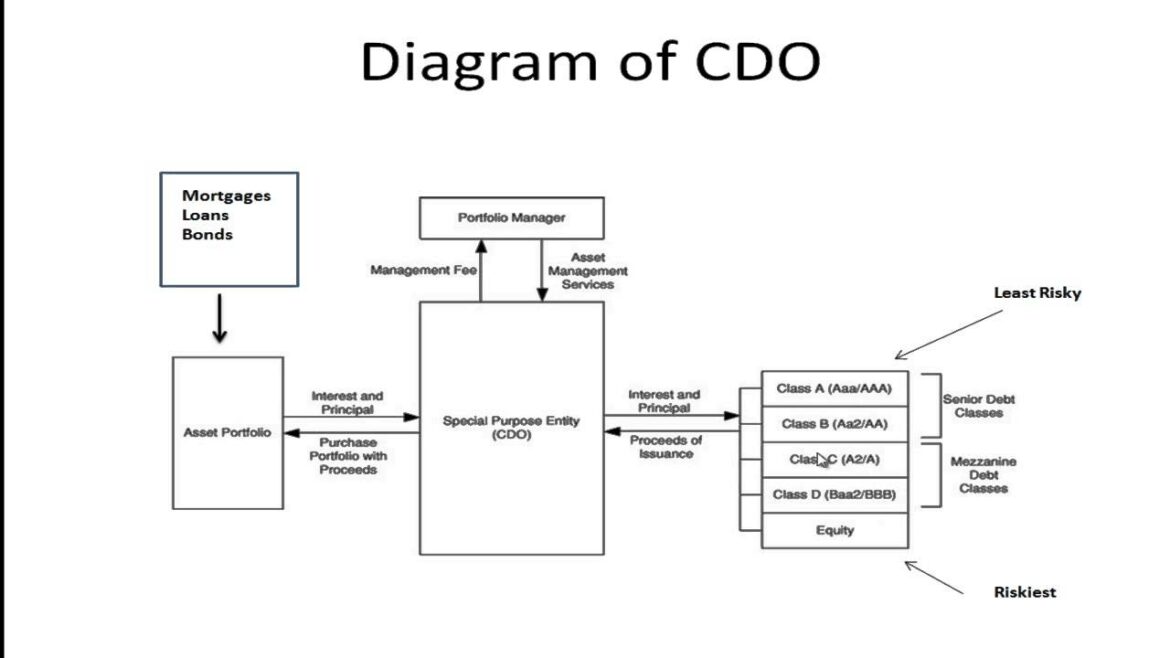

A Collateralized Debt Obligation, or CDO, is a form of financial instrument used to pool together various types of debt assets and repackage them into securities. These securities are then sold to investors in the form of bonds or other asset-backed securities. The purpose of this structure is to reduce risk by spreading out the assets among different investors and creating diversification within an investment portfolio.

CDOs can be divided into two main categories: cash flow CDOs and synthetic CDOs. Cash flow CDOs contain pieces of debt that generate periodic payments over time, such as mortgage-backed securities or auto loans. Synthetic CDOs typically involve credit default swaps (CDSs), which are contracts between buyers and sellers that allow for the transfer of credit risk from one party to another without any underlying security being exchanged.

CDOs have been popular among institutional investors because they offer higher yields than more traditional investments like stocks or bonds while also providing diversification benefits since they package up multiple debt instruments at once. With this structure, investors assume less risk because their exposure is spread across many different assets rather than concentrated on just one type of security. In addition, these investments can often provide tax advantages due to differences in how interest income from certain types of debt instruments is treated under U.S federal tax law relative to other forms of income such as dividends from stocks or capital gains from bond trading activities..

However, there have been some criticisms leveled against the use of collateralized debt obligations due primarily to their complex nature making it difficult for individual retail investors to accurately assess potential risks associated with investing in them. Furthermore, during times when market conditions are unfavorable and defaults become more likely on certain types of debts included within a given portfolio such as subprime mortgages during the 2008 Financial Crisis , losses incurred by those holding leveraged positions can be significant even with diversification benefits offered by structuring these deals through CDO vehicles . As a result it’s important that before considering investing in any type structured product like this you should carefully review all available information pertaining both its underlying components as well as relevant regulatory framework governing its issuance including but not limited detailed disclosures provided by issuer .