What is Binance Pool?

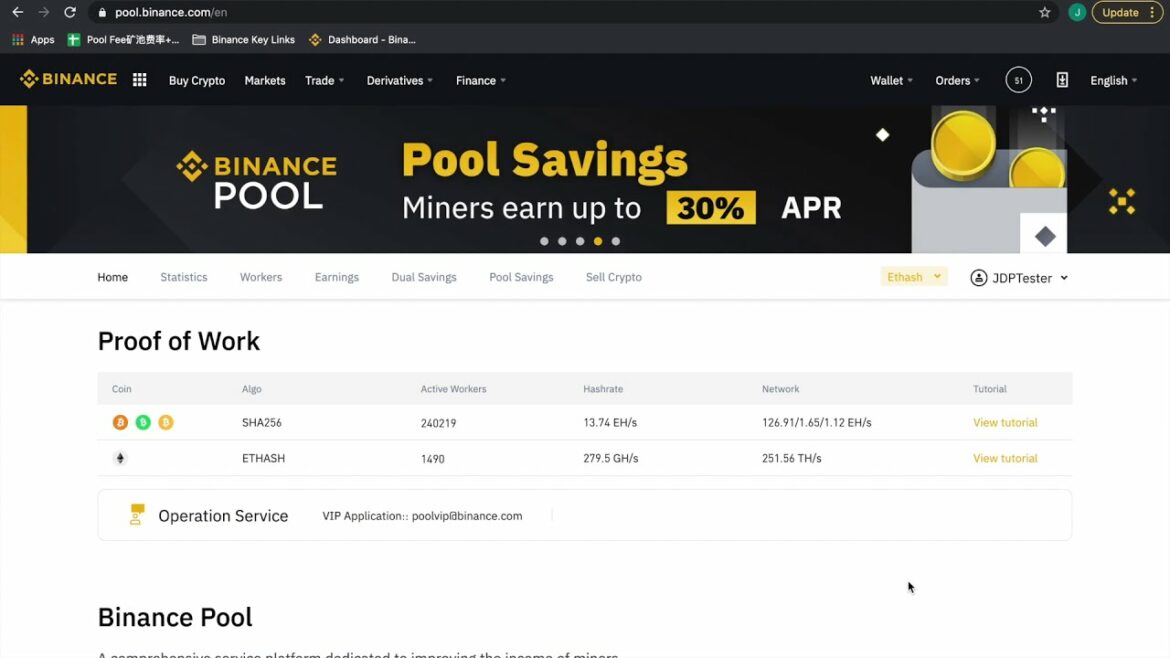

Binance Pool is a cryptocurrency mining pool created by the popular crypto exchange, Binance. It provides users with an easy and secure way to mine cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC). The platform has been designed to optimize profits for miners while providing them with low-cost electricity fees. In addition, it offers features like auto switch mining pools and shared staking rewards which makes it attractive to both novice and experienced miners alike. With its user friendly interface, simple setup process and competitive fee structure, Binance Pool has become one of the most popular mining solutions on the market today.

How Does Mining Work at Binance Pool?

Mining works differently from regular exchanges in that users need to download special software called “miners” in order to start mining their desired coins. These miners are responsible for verifying transactions made on the blockchain network in return for rewards paid out by networks themselves or through other third parties such as pools or exchanges like Binance itself. Miners can join existing public pool operations where they share processing power across multiple computers connected together through hashpower sharing protocols such as Stratum V2 or Ethash/DaggerHashimoto protocol; alternatively they can create private solo mines using their own hardware infrastructure if preferred over pooled solutions. Once set up correctly, all that remains is connecting your miner(s) directly into any one of many available global servers managed by dedicated teams who provide round-the-clock maintenance & support services tailored specifically towards optimising performance & profitability within each particular network environment .

How Much Can I Earn Through Mining at Binance Pool?

The amount you earn when mining depends heavily on several factors including but not limited to: type of coin being mined (Bitcoin vs Ethereum etc.), difficulty level associated with individual currencies algorithm structures , hashrate output from your equipment compared against others working within same specific blockchains consensus agreement systems , current price valuation per unit trading value metric etc.. Generally speaking however profit margins should remain approximately equal between different types of supported coins so long as pricing fluctuations remain constant over timeframes taken into consideration during calculations – Of course there may be some discrepancies here depending upon how much total hashing power contributed collectively amongst given sets participants thus resulting differences measured outcome payouts due each individually involved members final production outputs versus another contributing factor throughout entire collective duration period overall – Ultimately though provided everything operates smoothly then yes it’s possible make decent returns via profitable yields generated activities related engagement efforts invested within respective platforms infrastructures implemented active utilisation basis