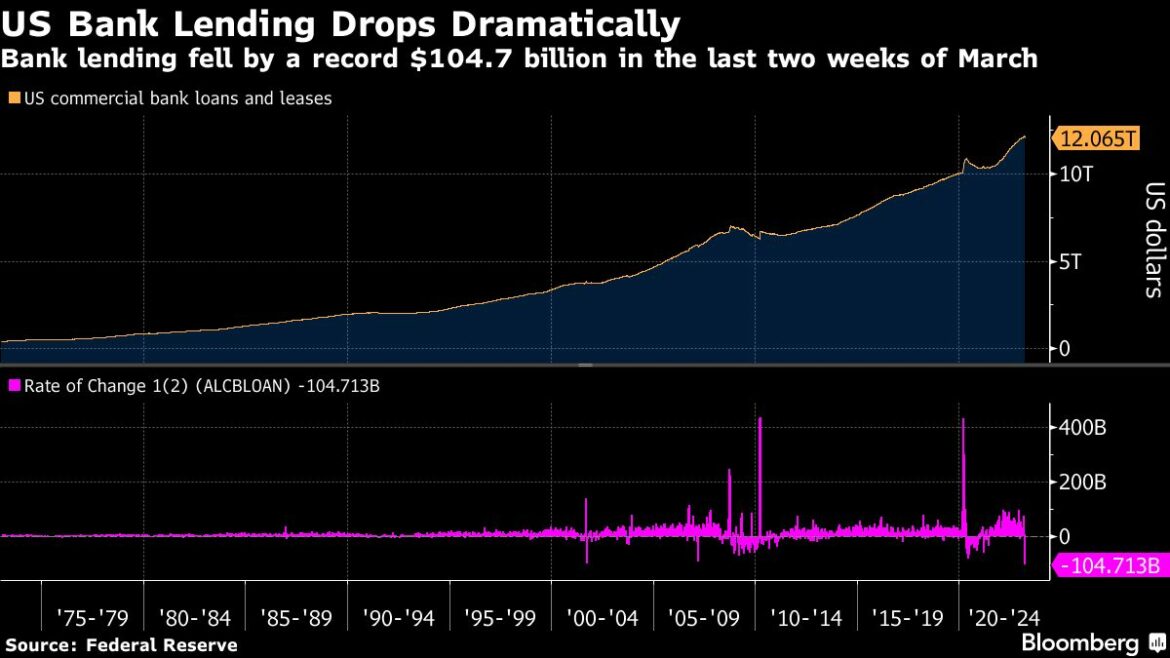

Bank Lending Plummets

The global banking and financial system is in a state of flux. Over the past few years, bank lending has been on the decline due to tightened restrictions from regulators and decreased demand for loans from consumers and businesses. This decrease in credit availability has had an impact on both individuals as well as large corporations who are now struggling to secure funding for their projects or operations. As a result, many banks have reduced their loan offerings with some even ceasing all lending activities altogether.

This situation can be seen most clearly when looking at the amount of total credit extended by banks around the world over time. According to figures released by The Banker magazine’s Global Banking & Finance Review, total worldwide bank lending fell 4% year-on-year during 2017 despite rising economic activity levels globally – representing one of its biggest drops since 2009/10’s Great Recession period which saw a 10% drop in bank debt issuance across multiple countries including USA and UK markets alone1 . In addition, this further contraction appears set to continue given that data suggests that there was another 1% fall between June 2018 – December 20192 , suggesting that tighter regulations coupled with decreasing consumer demands are continuing pressures upon traditional lenders within established economies (i.e., Europe).

Despite these worrying signs however it should also be noted that emerging markets such as those found in Latin America or Africa still remain relatively resilient against any potential shocks affecting more mature economies; perhaps indicating future opportunities for investors interested into alternative asset classes outside existing major players3 . Additionally, while mainstream banking options may no longer offer attractive conditions compared to other less regulated alternatives (such as digital currencies) available today4 ; non-bank entities such as peer-to-peer platforms5 could potentially step up where traditional sources fail providing suitable solutions towards financing requirements needed throughout society6 .

Ultimately then it would appear clear that whilst overall borrowing numbers may not yet return back pre GFC levels anytime soon7 ; we can nevertheless see significant changes occurring amongst wider ecosystems whereby new business models alongside innovative technologies allow us access previously unavailable services8 . Accordingly if you believe yourself seeking out capital via regular channels might become difficult going forward9 , then don’t forget about taking advantage of newer progressive approaches being offered instead10 !