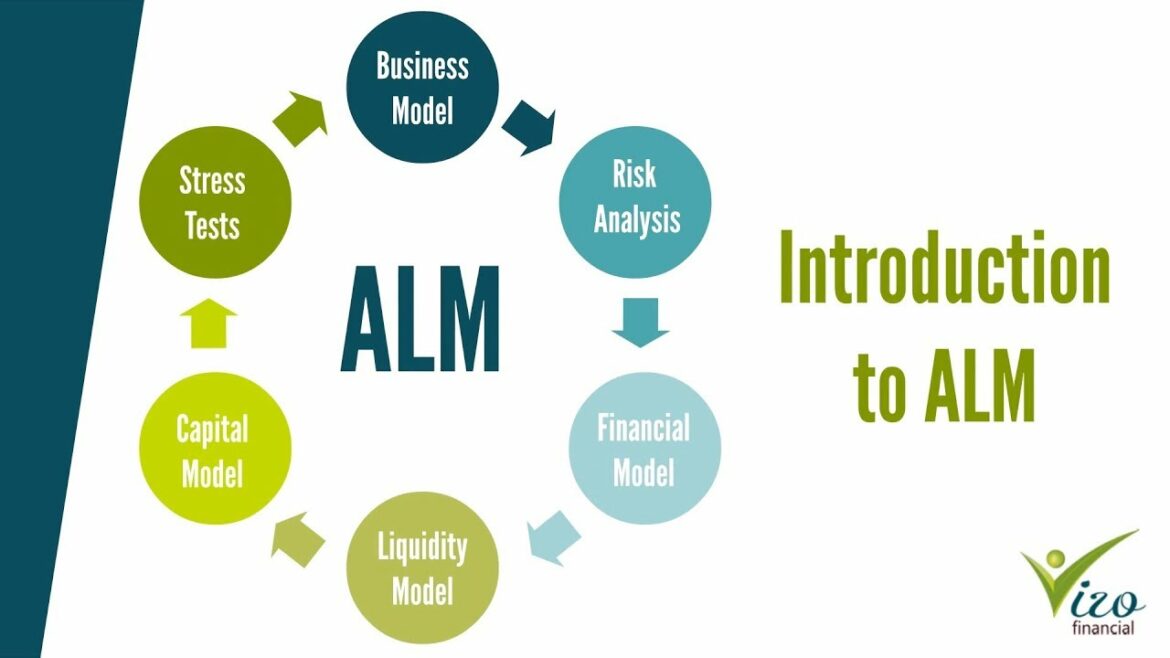

Asset-Liability Management (ALM) is the practice of managing a business’ assets and liabilities in order to reduce financial risk and maximize profits. ALM helps businesses make informed decisions about their investments, borrowing, and other transactions by allowing them to consider both potential risks as well as expected returns on those investments. The goal of asset-liability management is to create an optimal balance between short-term liquidity needs and long-term investment goals while minimizing overall risk exposure.

For cryptocurrency companies specifically, ALM can be used for several purposes including:

– Determining the most efficient use of capital resources: By analyzing all available information regarding current market conditions, cash flow projections, legal requirements, etc., crypto companies are able to identify opportunities with the greatest return on investment while also being aware of any associated risks that may arise from investing in certain projects or initiatives.

– Establishing proper levels of reserve funds: Crypto firms should ensure they have enough liquid reserves available at any given time so that they are prepared for unexpected costs or changes within the industry landscape which could cause disruptions in operations or require additional spending in order to remain competitive during tough times. This will help protect against losses due to unforeseen events such as regulatory uncertainty or rapid devaluation of cryptocurrencies among others factors which are common occurrences within this space yet difficult predictors when it comes time for making strategic plans & budgets far into advance.

– Setting appropriate debt limits: Cryptocurrency startups often need access to credit lines & loans especially early on when trying grow quickly but without taking excessive amounts leverage than necessary; therefore its important manage debt wisely through setting reasonable caps according total amount owed relative company’s size/assets & ability pay back creditors based upcoming revenue streams projected going forward over medium term period (i..e 6 months). Doing so allows firm maintain good relationships investors/creditors who trust organization prudently handle finances responsibly despite volatile nature surrounding digital currency markets otherwise would increase likelihood defaults payments leading high interest rates higher chances bankruptcy down road if not managed correctly from start off properly planned out strategies implemented place accordingly preemptively head these issues before becoming major problems later date .