American Bank Failures

The United States has a long history of bank failures, with more than 8,000 banks failing between the late 1700s and early 2000s. The most notable period of bank failure came during the Great Depression in the 1930s when nearly 10% of U.S. banks failed due to economic conditions caused by the stock market crash of 1929.

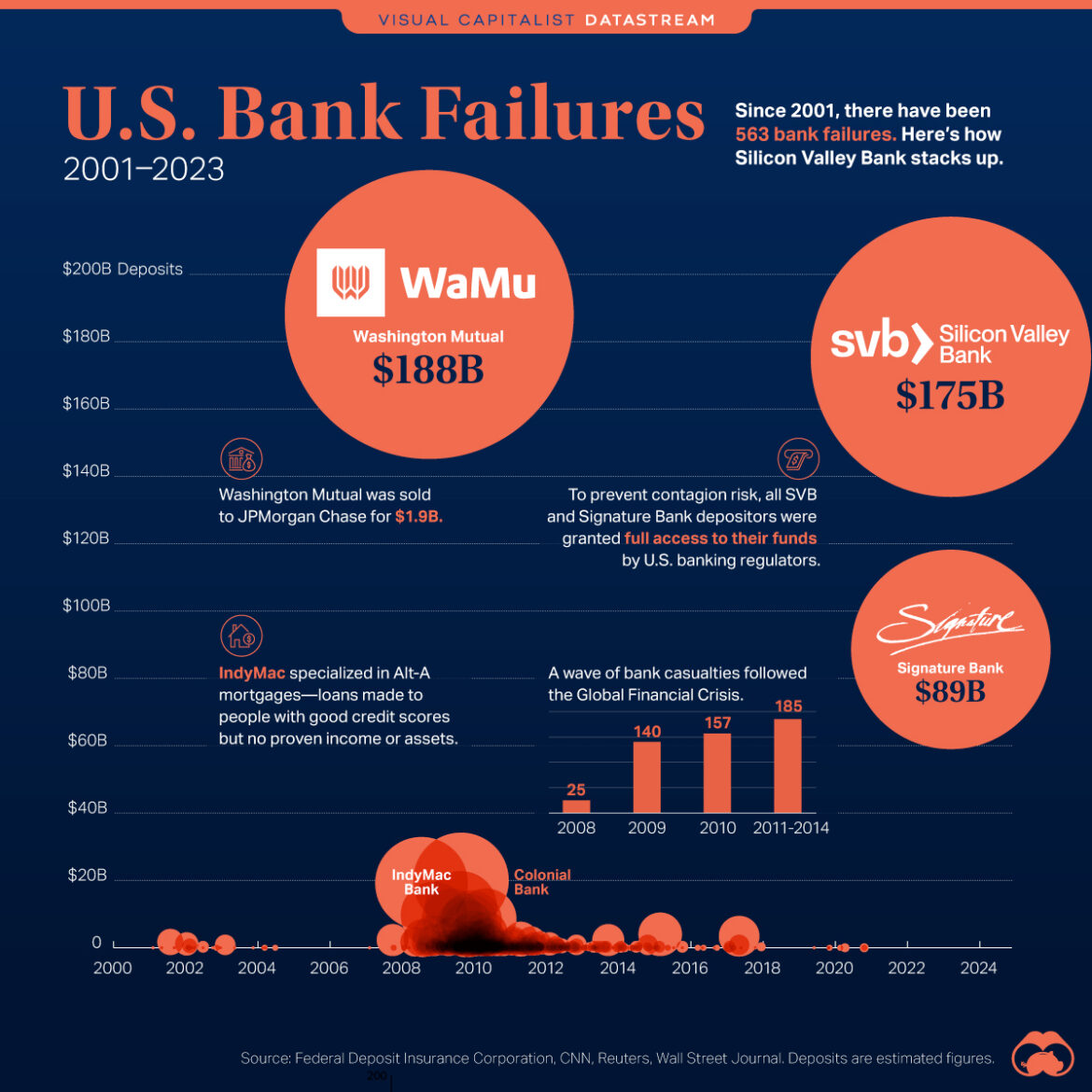

Since then, federal regulations have been put into place to help prevent similar events from occurring again in the future; however, there continue to be instances where American banks fail today as well. While these occurrences are typically not as widespread or catastrophic as what happened during the Great Depression era, it is still important for consumers to understand why this happens and how they can protect themselves against potential losses should their own financial institution ever close its doors unexpectedly.

There are several reasons why an American bank could potentially fail: poor management decisions resulting in high levels of debt that cannot be repaid; lack of liquidity leading to inability for customers withdraw funds without significant delays; insolvency because assets do not match liabilities (e., too many loans made out that can’t be paid back); fraudulent activities such as embezzlement/money laundering; cyber-attacks causing data breaches which expose customer information and cause trust issues among customers who may choose other banking options instead; natural disasters like floods or fires destroying physical locations or vital documents needed for operation etc..

In order to reduce your risk if you are a customer at a failing bank, you should keep up with news reports on any potential closures so that you can take action ahead of time if necessary – such as moving your money elsewhere before closure becomes official – depending on whether or not FDIC insurance covers your deposits (typically only up $250k per account). Additionally consider diversifying investments across multiple institutions – even those outside US borders – since no single entity is immune from trouble entirely though some might offer better protection than others depending on country laws & regulations related crypto currencies especially given evolving taxation rules . Lastly remember always read terms & conditions carefully prior opening new accounts so know exactly what would happen worst case scenario occur involving one’s finances suddenly evaporating seemingly overnight yet remain safely stored away somewhere else impossible access anyone other yourself!